BackyardProduction

Over the 2010-2021 timeframe, markets tended to be very generous with multiples for development business. If you produced development, financiers were all set to look far into the future to come up with a form of an affordable outcome. This silliness reached its peak in 2021. Simply take a look at the bullish cases for SPACs and current IPOs of the time. Many financiers were making bullish cases based upon 2030 incomes. They needed to, since individuals would need to be outrageous to purchase them for the 2023 numbers. This mania reversed in 2022 and for a bargain of business (a minimum of any business without an AI reference), reveals no indications of returning.

The Business

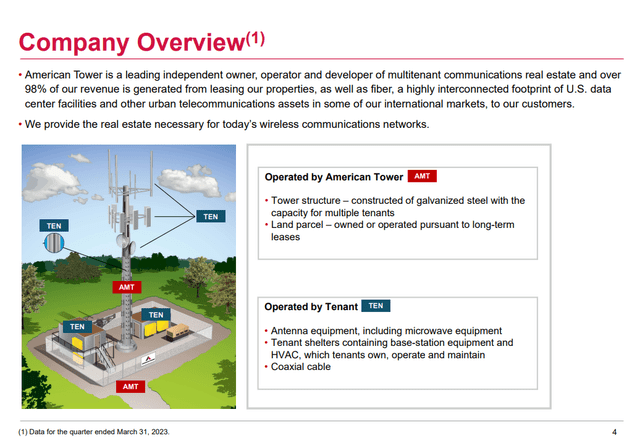

American Tower Corporation ( NYSE: AMT) is one where financiers kept up the development story and ran too far with it. As a leading owner of towers, the story was simple to cell

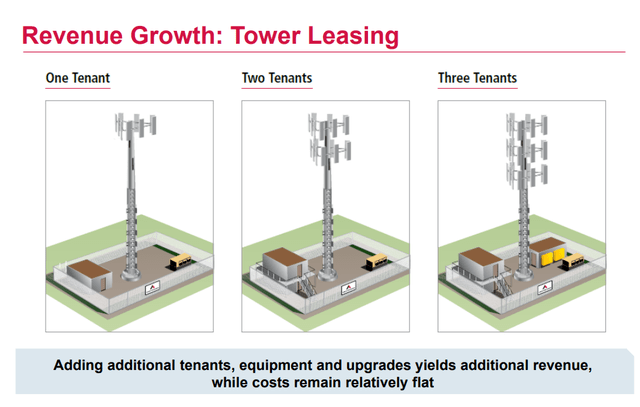

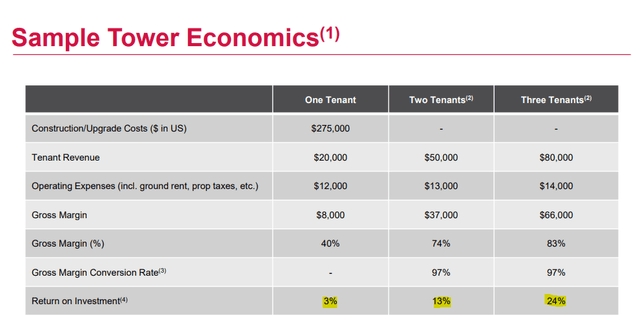

The name of the video game was utilize. 3 renters were even more rewarding than 3 times the revenues for one occupant.

AMT broke this mathematics even more for everybody so you might see the numbers they were discussing.

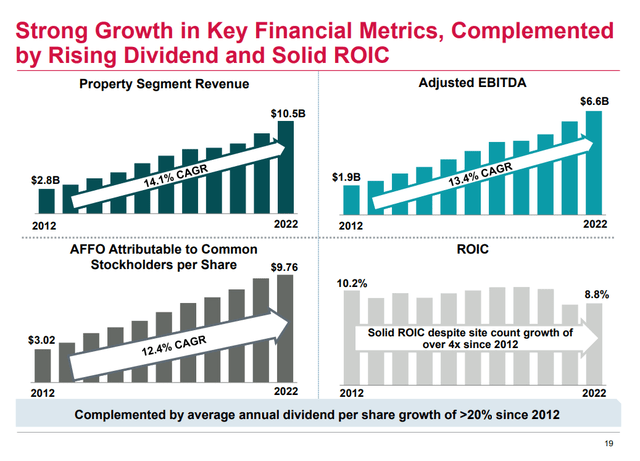

This was all real and AMT has actually been a real success story over the 2010-2022 duration. The numbers were merely sensational consisting of a 20% intensified dividend development!

However the longer things go this well, the larger the blowback is when they stop going so well.

An Evaluation Trip

Just Like the majority of our work, we concentrate on the huge appraisal image. If you desire more granular information on the most recent tower developed or the minutiae around the 1% motion in earnings outlook, this is not the location to discover it. The huge image is what drives investing for us and the crucial reason that we have actually not touched this in spite of the crowd freaking for this. That broad view likewise reveals why this is headed lower. Let us discuss.

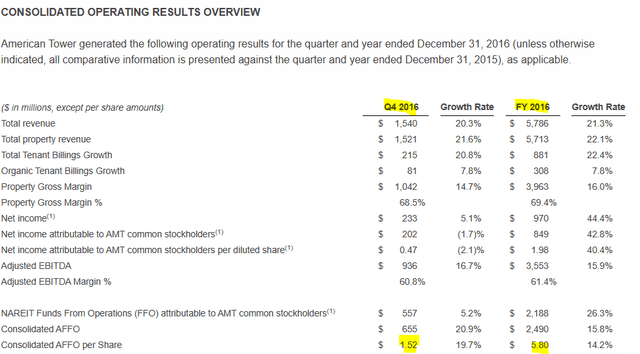

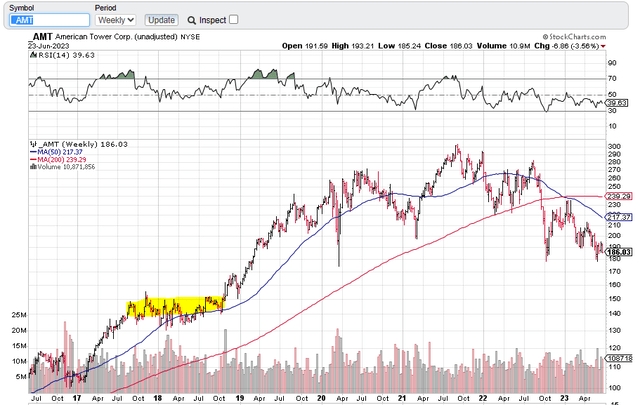

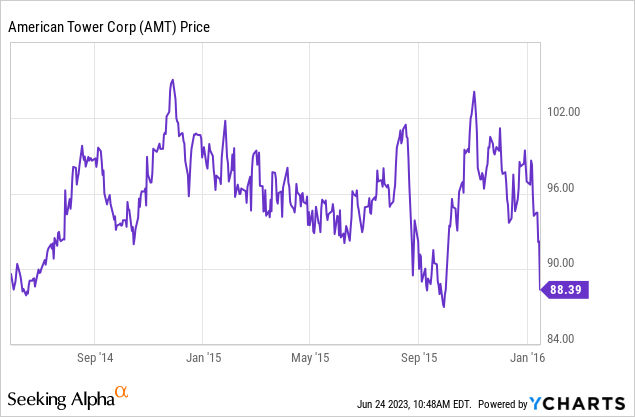

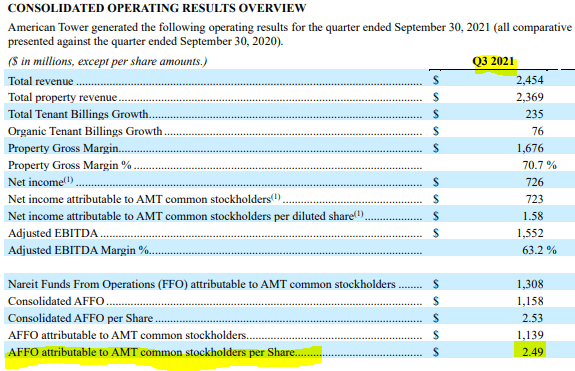

If you take a look at the slide above, it appears like a tough story not to like. However your return profile might be truly various than what those numbers reveal. While those earnings, changed EBITDA and changed funds from operations (AFFO) trajectories look extremely constant, the multiples financiers spent for this were anything however. Here is one information point. Financiers pressed AMT to $88 in 2016.

That would be close to 15.2 times what would end up being the AFFO for 2016. If you utilized the Q4-2016 run-rate you were paying less than 14.5 X AFFO.

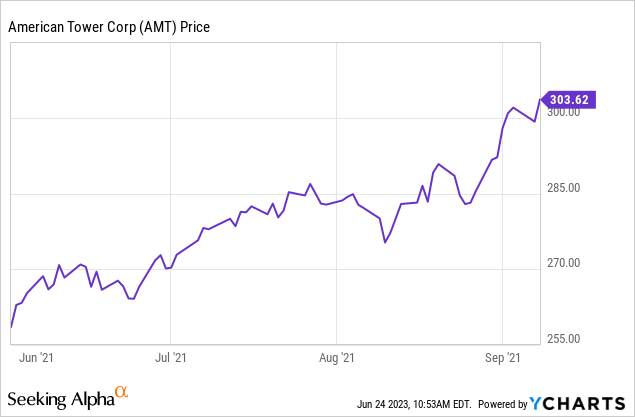

Quick forward to 2021 and financiers had actually simply ended up going raving mad, bidding AMT approximately over $303 a share.

That was 30X the AFFO (annualized) for the Q3-2021 quarter.

Q3-2021 Outcomes

Our point is that we saw practically 100% several variety for a regularly growing stock. So financiers continuously arguing a “buy-story” at each and every single point, without regard to appraisal, can encounter difficulty. That is specifically what took place after the last development groupies were absorbed.

Where Are We Today?

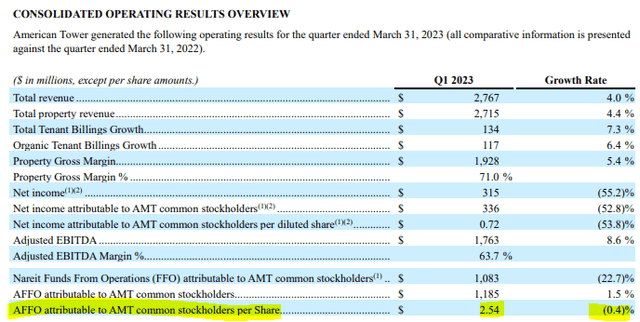

In the most current quarter AMT reported AFFO of $2.54.

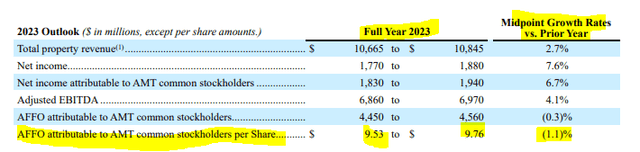

You do not need to have a fantastic memory to keep in mind that over 6 quarters from Q3-2021, the AFFO has actually hardly budged. It worsens for the development story. 2023 assistance is now for a 1.1% decrease in AFFO per share vs 2022.

Exit run rates are once again listed below the Q3-2021 numbers we revealed you. It is genuinely sensational how financiers are stopping working to acknowledge simply how materially the story has actually altered. Beginning With Q1-2021, all the method to our anticipated Q4-2023, the business’s AFFO will be flat. You have a 3 year timeframe of absolutely no development. You can yell from the cellular phone tower tops about information use increasing and you will not get any arguments from us. However where is the development in AFFO for AMT?

Outlook And Decision

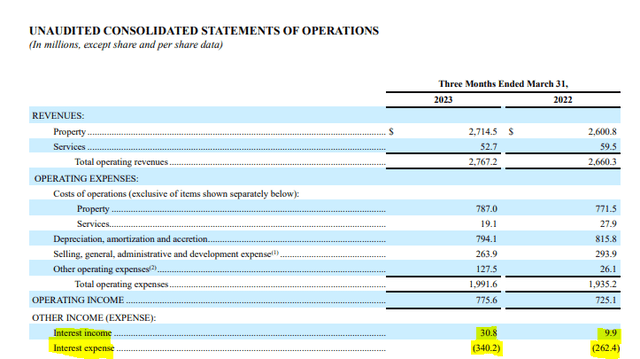

Organic billings in fact had a strong proving and the 5.6% development rate in Q1- 2023 was extremely great. The balanced out here is that the rolling off of the Sprint agreements has actually kept adjusted EBITDA under pressure. Increasing interest cost (even representing greater interest made on money balances) has actually done the remainder of the damage.

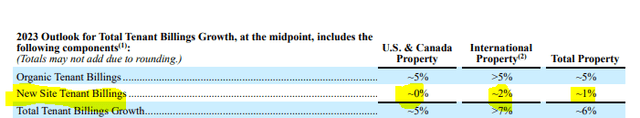

Brand-new website occupant billings were in fact assisted for 0% for 2023 in the United States. Even global is anticipated at simply 2% ( was 13% in 2021).

Bears have actually frequently argued that technological advances and the relocate to 5G will enable providers to utilize less standard cellular phone towers. We do not always purchase that theory, however little cell implementation is most likely to challenge the long term development rate presumptions for AMT. AMT likewise paid too much enormously for CoreSite. We normally believe information centers are a bad story and Digital Real estate Trust Inc. ( DLR) is a prime example of how bad that story is So that AMT acquisition most likely serve as a larger albatross around the development story’s neck. What we are most likely to see more than anything else is a selling climax where financiers lastly include the tower We believe at a minimum we will see the $150 mark as that takes place.

You had AMT trade at a 14-15X several even when it was growing highly. You had that occur in a period with pinned absolutely no percent rates. You truly think that we will not go there when safe rates are 5% and AMT has stopped growing AFFO for 3 years?

From a technical perspective, the stock had a significant debt consolidation in the $140-$ 150 variety for well over a year prior to it broke out and went on its development sprint.

We believe that zone will be challenged. AMT is still pricey at 19X AFFO, for a “no-growth” business. Crown Castle Inc. ( CCI) which we composed on just recently, has actually broken to brand-new 52 lows and trades at 14.3 X AFFO several. It appears a matter of time prior to AMT signs up with that sub 15.0 X several group. We are presently on the sidelines here and our pain-rating scale reveals the business as essentially misestimated.

We would seek to get included near the $140 zone.

Please keep in mind that this is not monetary recommendations. It might look like it, seem like it, however remarkably, it is not. Financiers are anticipated to do their own due diligence and talk to an expert who understands their goals and restraints.