David McNew

Revenues of Banc of California, Inc. ( NYSE: BANC) will most likely decrease this year due to a lower typical loan balance following a number of quarters of a drop. I’m anticipating the business to report profits of $1.41 per share for 2023, down 26% year-over-year. Compared to my last report on the business, I have actually lowered my profits quote as I have actually reduced both my loan balance and margin quotes. The year-end target rate recommends a little benefit from the present market value. For that reason, I’m preserving a hold score on Banc of California.

Decreasing Loan Pattern Likely to Reverse Quickly

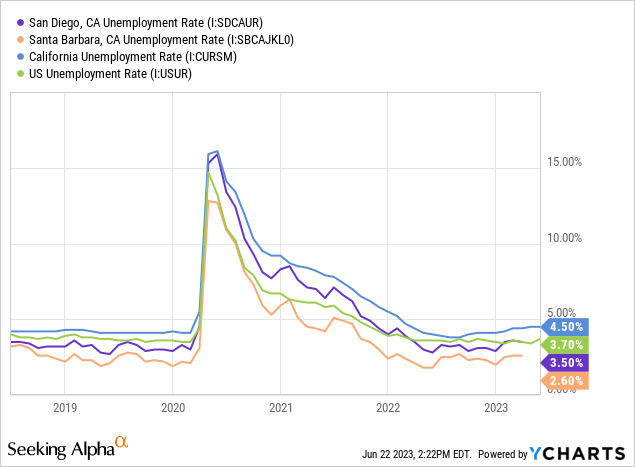

Throughout the very first quarter of 2023, Banc of California’s loan portfolio decreased for a 4th straight quarter. Thankfully, the rate of decrease reduced, which offers me hope that the pattern will bottom out quickly. Even more, the strength of regional economies will support a pattern turnaround. Banc of California runs throughout California with a concentration in the southern part of the state from San Diego to Santa Barbara. As revealed listed below, in spite of a current uptrend, the joblessness rates in Banc of California’s regional markets are still really low.

The management pointed out in the teleconference that “eventually we anticipate to be a net recipient of the present chaos in the banking market, both in regards to including brand-new customers and banking skill also.” This is tough to think thinking about the deposit book decreased by a considerable 2.4% (9.5% annualized) throughout the very first quarter of the year. Banc of California does not appear to have actually been much effective in catching the depositors leaving from other banks in the state. To remember, 2 banks running in California, SVB Financial ( OTCPK: SIVBQ) and Very First Republic Bank ( OTCPK: FRCB) struggled with deposit runs in March.

Even more, the increasing interest-rate environment is bound to suppress credit need. I’m anticipating the Fed funds rate to increase by 50 basis points in the 2nd half of 2023.

In General, I’m anticipating the loan portfolio to increase by 0.5% in each of the last 3 quarters of 2023, causing full-year loan development of 0.7%. In my last report, I approximated loan development of 4% for this year. I have actually lowered my quote since the very first quarter’s efficiency missed my expectation. Even more, the local joblessness rate has actually increased by more than I formerly prepared for. The following table reveals my balance sheet quotes.

| Monetary Position | FY18 | FY19 | FY20 | FY21 | FY22 | FY23E |

| Net Loans | 7,639 | 5,894 | 5,817 | 7,159 | 7,029 | 7,075 |

| Development of Net Loans | 15.6% | ( 22.8 )% | ( 1.3 )% | 23.1% | ( 1.8 )% | 0.7% |

| Other Making Possessions | 2,370 | 1,280 | 1,415 | 1,502 | 1,378 | 2,295 |

| Deposits | 7,917 | 5,427 | 6,086 | 7,439 | 7,121 | 7,057 |

| Loanings and Sub-Debt | 1,696 | 1,398 | 822 | 820 | 1,002 | 2,038 |

| Typical equity | 714 | 717 | 712 | 970 | 960 | 1,004 |

| Book Worth Per Share ($) | 14.2 | 14.3 | 14.3 | 16.0 | 16.1 | 17.1 |

| Concrete BVPS ($) | 13.3 | 13.5 | 13.5 | 14.3 | 14.0 | 15.0 |

| Source: SEC Filings, Author’s Quotes (In USD million unless otherwise defined) | ||||||

Margin Likely to be Rangebound in the Year Ahead

Banc of California considerably increased its money and money equivalents throughout the very first quarter, from $181 million at the end of December 2022 to $974 million at the end of March 2023. While on the one hand, this procedure will buffer versus the dangers from the bank runs in BANC’s markets, on the other hand, it will result in cash drag. As an outcome, this risk-reducing action will pressurize the margin in the near term.

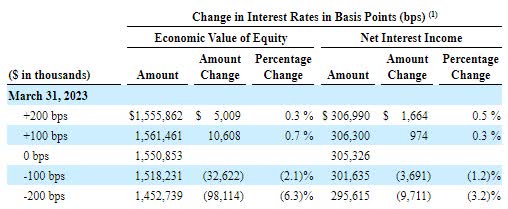

On the other hand, increasing rates of interest will have a little favorable result on the margin. Around 54% of loans vary or hybrid, as pointed out in the profits discussion Nevertheless, due to the big balance of securities, overall rate-sensitive properties are simply 37% of overall properties. Even more, the big balance of interest-bearing deal deposits will stifle the effect of rate walkings on the margin.

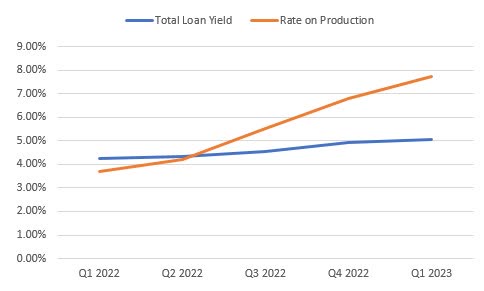

Thankfully, loan additions will assist the margin as Banc of California has actually been coming from brand-new loans at much greater rates than the typical rates on the overall loan portfolio.

1Q 2023 Revenues Discussion

The outcomes of the management’s rate-sensitivity analysis given up the 10-Q filing reveal that a 200-basis points trek in rates might increase the net interest earnings by simply 0.5% over twelve months.

1Q 2023 10-Q Filing

Thinking about these elements, I’m anticipating the margin to hardly alter in the last 3 quarters of 2023. Compared to my last report on the business, I have actually lowered my margin quote for this year partially since the margin decreased by more than I ‘d anticipated in the very first quarter. Even more, my outlook isn’t as favorable as previously.

Decreasing my Revenues Price Quote

As I have actually chosen to lower both my margin and loan balance quotes, I have actually reduced my profits quote for 2023. I’m now anticipating Banc of California to report profits of $1.41 per share for 2023, compared to my previous quote of $1.70 per share.

Compared to in 2015, profits of the business will likely be lower this year since of the loan portfolio’s decreasing pattern in the current past, which will lead to a lower typical loan balance for this year. Even more, I’m anticipating the provisioning for loan losses to go back to a typical level this year after extreme arrangement turnarounds in 2015. The following table reveals my earnings declaration quotes.

| Earnings Declaration | FY18 | FY19 | FY20 | FY21 | FY22 | FY23E |

| Net interest earnings | 286 | 248 | 225 | 254 | 314 | 304 |

| Arrangement for loan losses | 30 | 36 | 30 | 7 | ( 32 ) | 13 |

| Non-interest earnings | 24 | 12 | 19 | 19 | 17 | 32 |

| Non-interest cost | 233 | 196 | 199 | 183 | 194 | 208 |

| Earnings – Class A | 23 | 3 | ( 1 ) | 50 | 115 | 83 |

| EPS – Watered Down -Class A ($) | 0.45 | 0.05 | -0.02 | 0.95 | 1.89 | 1.41 |

| Source: SEC Filings, Revenues Releases, Author’s Quotes (In USD million unless otherwise defined) | ||||||

Threat Level Appears Moderate

In my viewpoint, the most significant source of danger for Banc of California is its place. The 2 current deposit works on banks happened in California, particularly SVB Financial and First Republic Bank.

Apart from the place, the danger level is low.

Uninsured and uncollateralized deposits were 27% of overall deposits at the end of March 2023. Although the percentage of uninsured/uncollateralized deposits in overall deposits is high, I’m not fretted since these deposits are well covered. Banc of California had overall offered liquidity of $4.0 billion, consisting of $1.0 billion of money, as pointed out in the profits discussion. This liquidity was 2.2 times the uninsured and uncollateralized deposits.

Even More, although Banc of California has a big securities portfolio, the latent mark-to-market losses on the portfolio are rather low. These latent losses totaled up to $47 million on the Available-for-Sale portfolio, which is simply 5% of the equity book worth.

Preserving a Hold Ranking

Banc of California is providing a dividend yield of 3.5% at the present quarterly dividend rate of $0.10 per share. The profits and dividend quotes recommend a payment ratio of 28% for 2023, which is quickly sustainable. For that reason, the dividend appears safe.

I’m utilizing the peer typical price-to-tangible book (” P/TB”) and price-to-earnings (” P/E”) multiples to worth Banc of California. Peers are trading at a typical P/TB ratio of 0.9 and a typical P/E ratio of 7.4, as revealed listed below.

| BANC | BY | DCOM | QCRH | EGBN | CTBI | Peer Average | |

| P/E (” ttm”) | 7.5 | 7.6 | 4.6 | 6.9 | 5.7 | 8.0 | 6.6 |

| P/E (” fwd”) | 8.8 | 7.5 | 6.4 | 7.2 | 7.3 | 8.6 | 7.4 |

| P/B (” ttm”) | 0.7 | 0.9 | 0.6 | 0.9 | 0.5 | 1.0 | 0.8 |

| P/TB (” ttm”) | 0.8 | 1.1 | 0.8 | 1.1 | 0.6 | 1.1 | 0.9 |

| Source: Looking For Alpha | |||||||

Increasing the typical P/TB numerous with the projection concrete book worth per share of $15.0 offers a target rate of $13.8 for completion of 2023. This rate target suggests an 18% upside from the June 23 closing rate. The following table reveals the level of sensitivity of the target rate to the P/TB ratio.

| P/TB Several | 0.72 x | 0.82 x | 0.92 x | 1.02 x | 1.12 x |

| TBVPS – Dec 2023 ($) | 15.0 | 15.0 | 15.0 | 15.0 | 15.0 |

| Target Cost ($) | 10.8 | 12.3 | 13.8 | 15.3 | 16.8 |

| Market Value ($) | 11.7 | 11.7 | 11.7 | 11.7 | 11.7 |

| Upside/( Disadvantage) | ( 7.8 )% | 5.1% | 18.0% | 30.9% | 43.7% |

| Source: Author’s Quotes |

Increasing the typical P/E numerous with the projection profits per share of $1.41 offers a target rate of $10.4 for completion of 2023. This rate target suggests a 10.7% drawback from the June 23 closing rate. The following table reveals the level of sensitivity of the target rate to the P/E ratio.

| P/E Several | 5.4 x | 6.4 x | 7.4 x | 8.4 x | 9.4 x |

| EPS 2023 ($) | 1.41 | 1.41 | 1.41 | 1.41 | 1.41 |

| Target Cost ($) | 7.6 | 9.0 | 10.4 | 11.8 | 13.2 |

| Market Value ($) | 11.7 | 11.7 | 11.7 | 11.7 | 11.7 |

| Upside/( Disadvantage) | ( 34.8 )% | ( 22.7 )% | ( 10.7 )% | 1.4% | 13.5% |

| Source: Author’s Quotes |

Similarly weighting the target rates from the 2 appraisal techniques offers a combined target rate of $12.1, which suggests a 3.7% upside from the present market value. Including the forward dividend yield offers an overall anticipated return of 7.1%. For this reason, I’m preserving a hold score on Banc of California.