Posted by Dominik Mengelt, Developer Relations Engineer, Google Pay and Nick Alteen, Technical Writer, Engineering, Wallet

What is step-up authentication?

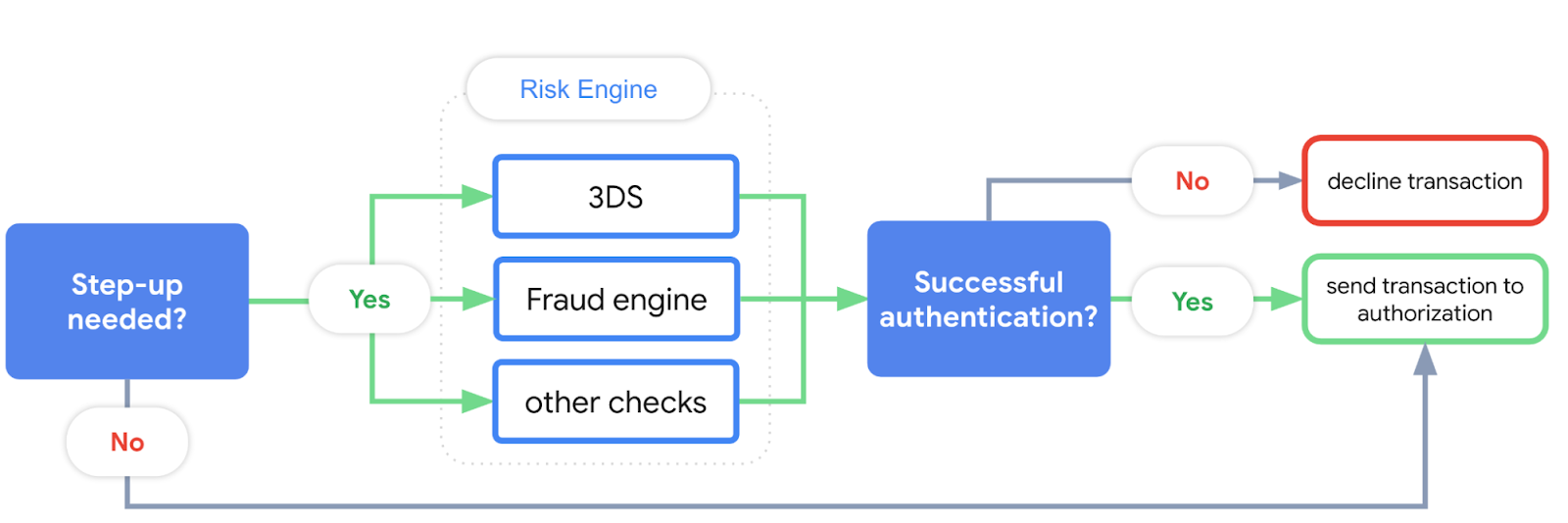

When processing payments, step-up authentication (or simply “step-up”) is the practice of requiring additional authentication measures based on user activity and certain risk signals. For example, redirecting the user to 3D Secure to authenticate a transaction. This can help to reduce potential fraud and chargebacks. The following graphic shows the high-level flow of a transaction to determine what’s to be done if step-up is needed.

|

| Figure 1: Trigger your Risk Engine before sending the transaction to authorization if step-up is needed |

It depends! When making a transaction, the Google Pay API response will return one of the following:

- An authenticated payload that can be processed without any further step-up or challenge. For example, when a user adds a payment card to Google Wallet. In this case, the user has already completed identity verification with their issuing bank.

- A primary account number (PAN) that requires additional authentication measures, such as 3D Secure. For example, a user making a purchase with a payment card previously stored through Chrome Autofill.

You can use the allowedAuthMethods parameter to indicate which authentication methods you want to support for Google Pay transactions:

In this case, you’re asking Google Pay to display the payment sheet for both types. For example, if the user selects a PAN_ONLY card (a card not tokenized, not enabled for contactless) from the payment sheet during checkout, step-up is needed. Let’s have a look at two concrete scenarios:

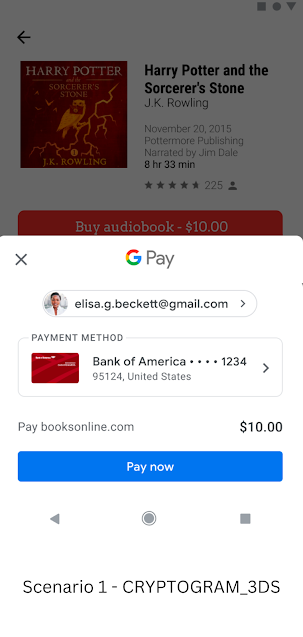

In the first scenario, the Google Pay sheet shows a card previously added to Google Wallet. The card art and name of the user’s issuing bank are displayed. If the user selects this card during the checkout process, no step-up is required because it would fall under the CRYPTOGRAM_3DS authentication method.

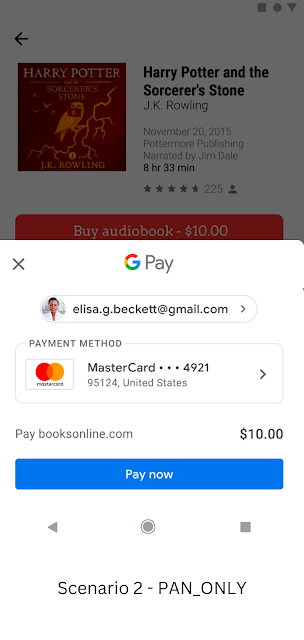

On the other hand, the sheet in the second scenario shows a generic card network icon. This indicates a PAN_ONLY authentication method and therefore needs step-up.

PAN_ONLY vs. CRYPTOGRAM_3DS

Whether or not you decide to accept both forms of payments is your decision. For CRYPTOGRAM_3DS, the Google Pay API additionally returns a cryptogram and, depending on the network, an eciIndicator. Make sure to use those properties when continuing with authorization.

When should you step-up Google Pay transactions?

When calling the loadPaymentData method, the Google Pay API will return an encrypted payment token (paymentData.paymentMethodData.tokenizationData.token). After decryption, the paymentMethodDetails object contains a property, assuranceDetails, which has the following format:

Depending on the values of cardHolderAuthenticated and accountVerified, step-up authentication may be required. The following table indicates the possible scenarios and when Google recommends step-up authentication for a transaction:

Step-up can be skipped only when both cardHolderAuthenticated and accountVerified return true.

Next steps

If you are not using assuranceDetails yet, consider doing so now and make sure to step-uptransactions if needed. Also, make sure to check out our guide on Strong Customer Authentication (SCA) if you are processing payments within the European Economic Area (EEA). Follow @GooglePayDevs on Twitter for future updates. If you have questions, mention @GooglePayDevs and include #AskGooglePayDevs in your tweets.