OMAHA, Neb.– Warren Buffett struck a downhearted tone about Berkshire Hathaway‘s myriad of services on Saturday, stating he anticipates a profits decrease due to a financial downturn.

” In the basic economy, the feedback we get is that, I would state, possibly most of our services will really report lower profits this year than in 2015,” the “Oracle of Omaha” informed 10s of countless investors at Berkshire’s 2023 yearly conference.

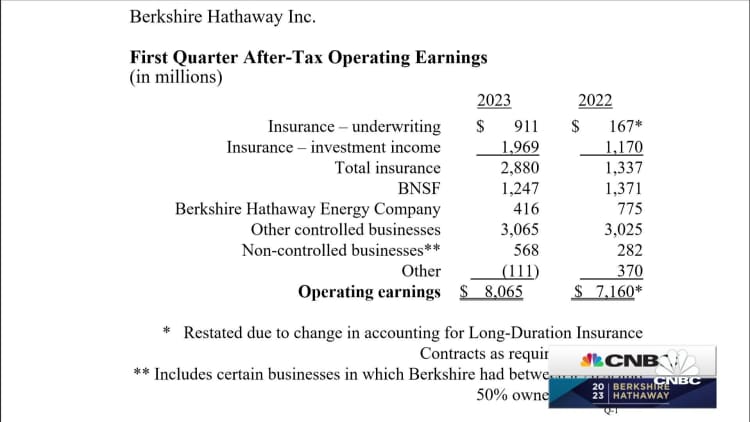

Berkshire has actually prospered up until now regardless of a tough macro environment with operating profits leaping 12.6% in the very first quarter The strong efficiency was driven by a rebound in the corporation’s insurance coverage company. General profits likewise increased dramatically thanks in part to gains its equity portfolio, led by Apple Berkshire’s railway company, BNSF, together with its energy business did see year-over-year profits decreases last quarter.

The 92-year-old investing icon thinks that a few of his supervisors at Berkshire subsidiaries were captured off guard by the quick modification in customer habits, as they put the Covid-19 pandemic behind them. This led them to overstating need for particular items, and now they will require sales to eliminate the excess stock.

” It is a various environment than it was 6 months earlier. And a variety of our supervisors were amazed,” Buffett stated. “A few of them had excessive stock on order, and after that suddenly it got provided, and individuals weren’t in the exact same state of mind as earlier.”

The U.S. economy is facing a series of aggressive rate walkings, which partially set off 3 bank failures in the period of simply a couple of weeks due to mismatched properties and liabilities. The Federal Reserve simply authorized its 10th rate walkings because 2022, taking the fed funds rate to a target variety of 5% -5.25%, the greatest because August 2007.

” It was more severe in The second world war, however this was severe this time,” Buffett stated.