{“page”:0,” year”:2023,” monthnum”:5,” day”:19,” name”:” disentangling-diversification”,” mistake”:””,” m”:””,” p”:0,” post_parent”:””,” subpost”:””,” subpost_id”:””,” accessory”:””,” attachment_id”:0,” pagename”:””,” page_id”:0,” 2nd”:””,” minute”:””,” hour”:””,” w”:0,” category_name”:””,” tag”:””,” feline”:””,” tag_id”:””,” author”:””,” author_name”:””,” feed”:””,” tb”:””,” paged”:0,” meta_key”:””,” meta_value”:””,” sneak peek”:””,” s”:””,” sentence”:””,” title”:””,” fields”:””,” menu_order”:””,” embed”:””,” classification __ in”: [],” classification __ not_in”: [],” classification __ and”: [],” post __ in”: [],” post __ not_in”: [],” post_name __ in”: [],” tag __ in”: [],” tag __ not_in”: [],” tag __ and”: [],” tag_slug __ in”: [],” tag_slug __ and”: [],” post_parent __ in”: [],” post_parent __ not_in”: [],” author __ in”: [],” author __ not_in”: [],” search_columns”: [],” ignore_sticky_posts”: incorrect,” suppress_filters”: incorrect,” cache_results”: real,” update_post_term_cache”: real,” update_menu_item_cache”: incorrect,” lazy_load_term_meta”: real,” update_post_meta_cache”: real,” post_type”:””,” posts_per_page”:” 5″,” nopaging”: incorrect,” comments_per_page”:” 50″,” no_found_rows”: incorrect,” order”:” DESC”}

[{“display”:”Craig Lazzara”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/craig_lazzara-353.jpg”,”url”:”https://www.indexologyblog.com/author/craig_lazzara/”},{“display”:”Tim Edwards”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/timothy_edwards-368.jpg”,”url”:”https://www.indexologyblog.com/author/timothy_edwards/”},{“display”:”Hamish Preston”,”title”:”Director, U.S. Equity Indices”,”image”:”/wp-content/authors/hamish_preston-512.jpg”,”url”:”https://www.indexologyblog.com/author/hamish_preston/”},{“display”:”Anu Ganti”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/anu_ganti-505.jpg”,”url”:”https://www.indexologyblog.com/author/anu_ganti/”},{“display”:”Fiona Boal”,”title”:”Managing Director, Global Head of Equities”,”image”:”/wp-content/authors/fiona_boal-317.jpg”,”url”:”https://www.indexologyblog.com/author/fiona_boal/”},{“display”:”Berlinda Liu”,”title”:”Director, Multi-Asset Indices”,”image”:”/wp-content/authors/berlinda_liu-191.jpg”,”url”:”https://www.indexologyblog.com/author/berlinda_liu/”},{“display”:”Jim Wiederhold”,”title”:”Director, Commodities and Real Assets”,”image”:”/wp-content/authors/jim.wiederhold-515.jpg”,”url”:”https://www.indexologyblog.com/author/jim-wiederhold/”},{“display”:”Phillip Brzenk”,”title”:”Managing Director, Global Head of Multi-Asset Indices”,”image”:”/wp-content/authors/phillip_brzenk-325.jpg”,”url”:”https://www.indexologyblog.com/author/phillip_brzenk/”},{“display”:”Howard Silverblatt”,”title”:”Senior Index Analyst, Product Management”,”image”:”/wp-content/authors/howard_silverblatt-197.jpg”,”url”:”https://www.indexologyblog.com/author/howard_silverblatt/”},{“display”:”Michael Orzano”,”title”:”Senior Director, Global Equity Indices”,”image”:”/wp-content/authors/Mike.Orzano-231.jpg”,”url”:”https://www.indexologyblog.com/author/mike-orzano/”},{“display”:”John Welling”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/john_welling-246.jpg”,”url”:”https://www.indexologyblog.com/author/john_welling/”},{“display”:”Wenli Bill Hao”,”title”:”Senior Lead, Strategy Indices”,”image”:”/wp-content/authors/bill_hao-351.jpg”,”url”:”https://www.indexologyblog.com/author/bill_hao/”},{“display”:”Maria Sanchez”,”title”:”Director, Sustainability Indices Product Management, Latin America”,”image”:”/wp-content/authors/maria_sanchez-243.jpg”,”url”:”https://www.indexologyblog.com/author/maria_sanchez/”},{“display”:”Silvia Kitchener”,”title”:”Director, Global Equity Indices, Latin America”,”image”:”/wp-content/authors/silvia_kitchener-522.jpg”,”url”:”https://www.indexologyblog.com/author/silvia_kitchener/”},{“display”:”Shaun Wurzbach”,”title”:”Managing Director, Head of Commercial Group (North America)”,”image”:”/wp-content/authors/shaun_wurzbach-200.jpg”,”url”:”https://www.indexologyblog.com/author/shaun_wurzbach/”},{“display”:”Akash Jain”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/akash_jain-348.jpg”,”url”:”https://www.indexologyblog.com/author/akash_jain/”},{“display”:”Ved Malla”,”title”:”Associate Director, Client Coverage”,”image”:”/wp-content/authors/ved_malla-347.jpg”,”url”:”https://www.indexologyblog.com/author/ved_malla/”},{“display”:”Rupert Watts”,”title”:”Senior Director, Strategy Indices”,”image”:”/wp-content/authors/rupert_watts-366.jpg”,”url”:”https://www.indexologyblog.com/author/rupert_watts/”},{“display”:”Jason Giordano”,”title”:”Director, Fixed Income, Product Management”,”image”:”/wp-content/authors/jason_giordano-378.jpg”,”url”:”https://www.indexologyblog.com/author/jason_giordano/”},{“display”:”Qing Li”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/qing_li-190.jpg”,”url”:”https://www.indexologyblog.com/author/qing_li/”},{“display”:”Ben Leale-Green”,”title”:”Associate Director, Research & Design, ESG Indices”,”image”:”/wp-content/authors/ben_leale-green-342.jpg”,”url”:”https://www.indexologyblog.com/author/ben_leale-green/”},{“display”:”Sherifa Issifu”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/sherifa_issifu-518.jpg”,”url”:”https://www.indexologyblog.com/author/sherifa_issifu/”},{“display”:”Glenn Doody”,”title”:”Vice President, Product Management, Technology Innovation and Specialty Products”,”image”:”/wp-content/authors/glenn_doody-517.jpg”,”url”:”https://www.indexologyblog.com/author/glenn_doody/”},{“display”:”Brian Luke”,”title”:”Senior Director, Head of Commodities and Real Assets”,”image”:”/wp-content/authors/brian.luke-509.jpg”,”url”:”https://www.indexologyblog.com/author/brian-luke/”},{“display”:”Priscilla Luk”,”title”:”Managing Director, Global Research & Design, APAC”,”image”:”/wp-content/authors/priscilla_luk-228.jpg”,”url”:”https://www.indexologyblog.com/author/priscilla_luk/”},{“display”:”Liyu Zeng”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/liyu_zeng-252.png”,”url”:”https://www.indexologyblog.com/author/liyu_zeng/”},{“display”:”Sean Freer”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/sean_freer-490.jpg”,”url”:”https://www.indexologyblog.com/author/sean_freer/”},{“display”:”Barbara Velado”,”title”:”Senior Analyst, Research & Design, Sustainability Indices”,”image”:”/wp-content/authors/barbara_velado-413.jpg”,”url”:”https://www.indexologyblog.com/author/barbara_velado/”},{“display”:”Cristopher Anguiano”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/cristopher_anguiano-506.jpg”,”url”:”https://www.indexologyblog.com/author/cristopher_anguiano/”},{“display”:”Benedek Vu00f6ru00f6s”,”title”:”Director, Index Investment Strategy”,”image”:”/wp-content/authors/benedek_voros-440.jpg”,”url”:”https://www.indexologyblog.com/author/benedek_voros/”},{“display”:”Andrew Innes”,”title”:”Head of EMEA, Global Research & Design”,”image”:”/wp-content/authors/andrew_innes-189.jpg”,”url”:”https://www.indexologyblog.com/author/andrew_innes/”},{“display”:”Michael Mell”,”title”:”Senior Director, Custom Indices”,”image”:”/wp-content/authors/michael_mell-362.jpg”,”url”:”https://www.indexologyblog.com/author/michael_mell/”},{“display”:”Rachel Du”,”title”:”Senior Analyst, Global Research & Design”,”image”:”/wp-content/authors/rachel_du-365.jpg”,”url”:”https://www.indexologyblog.com/author/rachel_du/”},{“display”:”Izzy Wang”,”title”:”Analyst, Strategy Indices”,”image”:”/wp-content/authors/izzy.wang-326.jpg”,”url”:”https://www.indexologyblog.com/author/izzy-wang/”},{“display”:”George Valantasis”,”title”:”Associate Director, Strategy Indices”,”image”:”/wp-content/authors/george-valantasis-453.jpg”,”url”:”https://www.indexologyblog.com/author/george-valantasis/”},{“display”:”Jason Ye”,”title”:”Director, Strategy Indices”,”image”:”/wp-content/authors/Jason%20Ye-448.jpg”,”url”:”https://www.indexologyblog.com/author/jason-ye/”},{“display”:”Eduardo Olazabal”,”title”:”Senior Analyst, Global Equity Indices”,”image”:”/wp-content/authors/eduardo_olazabal-451.jpg”,”url”:”https://www.indexologyblog.com/author/eduardo_olazabal/”},{“display”:”Fei Wang”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/fei_wang-443.jpg”,”url”:”https://www.indexologyblog.com/author/fei_wang/”},{“display”:”Jaspreet Duhra”,”title”:”Managing Director, Global Head of Sustainability Indices”,”image”:”/wp-content/authors/jaspreet_duhra-504.jpg”,”url”:”https://www.indexologyblog.com/author/jaspreet_duhra/”},{“display”:”Joseph Nelesen”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/joseph_nelesen-452.jpg”,”url”:”https://www.indexologyblog.com/author/joseph_nelesen/”},{“display”:”Ari Rajendra”,”title”:”Senior Director, Strategy & Volatility Indices”,”image”:”/wp-content/authors/Ari.Rajendra-400.jpg”,”url”:”https://www.indexologyblog.com/author/ari-rajendra/”},{“display”:”Louis Bellucci”,”title”:”Senior Director, Index Governance”,”image”:”/wp-content/authors/louis_bellucci-377.jpg”,”url”:”https://www.indexologyblog.com/author/louis_bellucci/”},{“display”:”Daniel Perrone”,”title”:”Director and Head of Operations, ESG Indices”,”image”:”/wp-content/authors/daniel_perrone-387.jpg”,”url”:”https://www.indexologyblog.com/author/daniel_perrone/”},{“display”:”Narottama Bowden”,”title”:”Director, ESG Index Intelligence, Index Governance”,”image”:”/wp-content/authors/narottama_bowden-331.jpg”,”url”:”https://www.indexologyblog.com/author/narottama_bowden/”},{“display”:”Lalit Ponnala”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/lalit.ponnala-388.jpg”,”url”:”https://www.indexologyblog.com/author/lalit-ponnala/”}]

Disentangling Diversity

We regularly hear that ” it’s a stock picker’s market.” The current market environment might similarly well be identified as a sector picker’s market

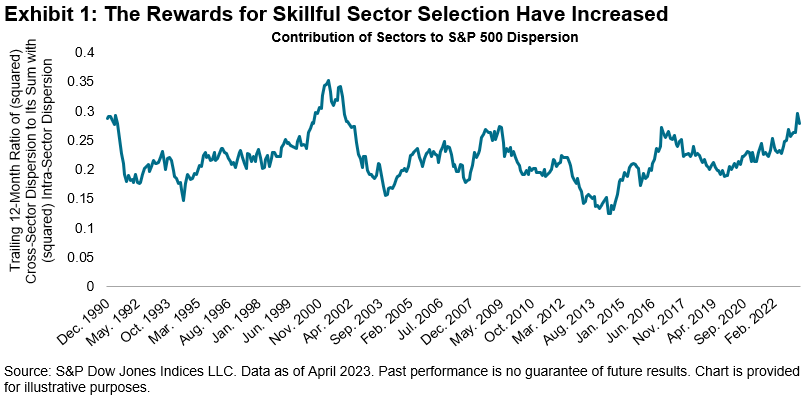

To determine the significance of sectors, we disintegrate overall market dispersion into within-sector and cross-sector impacts. Exhibition 1 reveals that the contribution of cross-sector impacts to overall S&P 500 ® dispersion has actually trended up this year, suggesting that the benefits for proficient sector choice have actually increased.

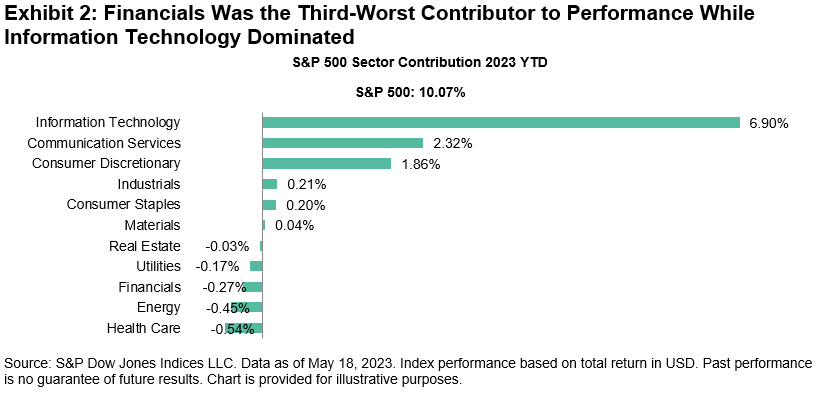

The current travails of the banking market have actually compromised the Financials sector, with the S&P 500 Financials down 4% YTD since Might 18, 2023. On the other hand, the general market has actually marched to a various drumbeat, with the S&P 500 up 10%. As Exhibition 2 highlights, the Financials sector was the third-biggest critic from S&P 500 efficiency, while Infotech was the dominant factor YTD.

As an outcome, financiers who overweighted Infotech or underweighted Financials would have been well rewarded, with the S&P 500 Ex-Financials up 12% YTD. Nevertheless, it deserves keeping in mind that the outperformance of IT has actually been much higher than the underperformance of Financials, with the S&P 500 Infotech up 28% YTD.

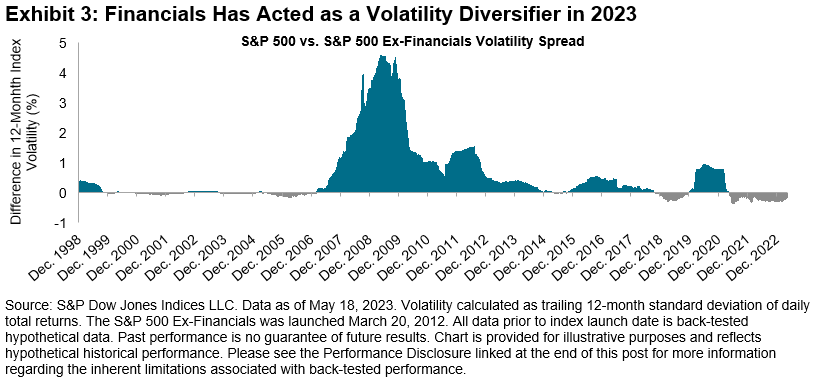

As sectors develop gradually, so does their diversity capacity. As we formerly checked out for Energy and Infotech, in Exhibition 3, we compute the spread in tracking 12-month volatility in between the S&P 500 and the S&P 500 Ex-Financials. When this spread is favorable, the addition of Financials increases volatility in the criteria; when unfavorable, the sector functions as a diversifier. Keep in mind the unfavorable spread for Financials up until now this year.

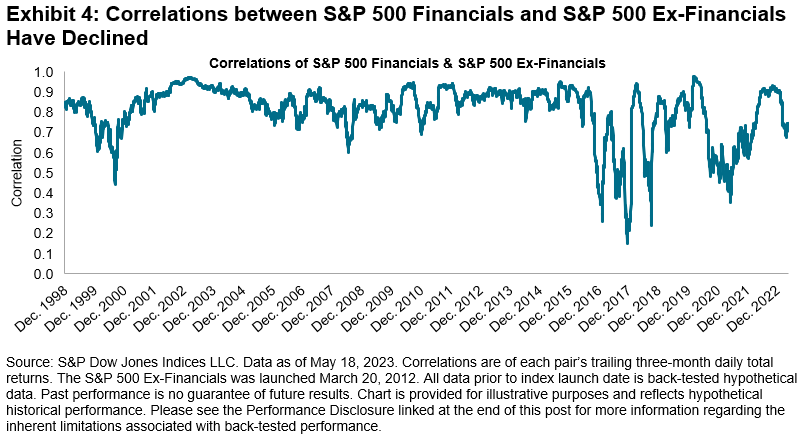

The Financials sector has actually ended up being a volatility diversifier since its connection with the remainder of the market has actually just recently decreased, as displayed in Exhibition 4.

While the Financials sector has actually just recently lowered volatility, this hasn’t constantly held true. For instance, throughout the depths of the 2008 Global Financial Crisis, the Financials sector was a significant source of volatility. Regardless of the sector’s failing relative efficiency up until now this year, its present danger positioning may possibly show advantageous for cautious sector allocators.

The posts on this blog site are viewpoints, not suggestions. Please read our Disclaimers

Describing Optimized Weights

-

Classifications

ESG -

Tags

environment, Environment Shift Indices, ESG, Index Building, enhanced weights, Paris Arrangement, S&P PACT Indices, S&P UK Net No 2050 Paris-Aligned ESG Index, S&P/ ASX 300 Net No 2050 Environment Shift ESG Index, S&P/ ASX 300 Net No 2050 Paris-Aligned ESG Index, sustainability, Sustainable Investing, weight attribution

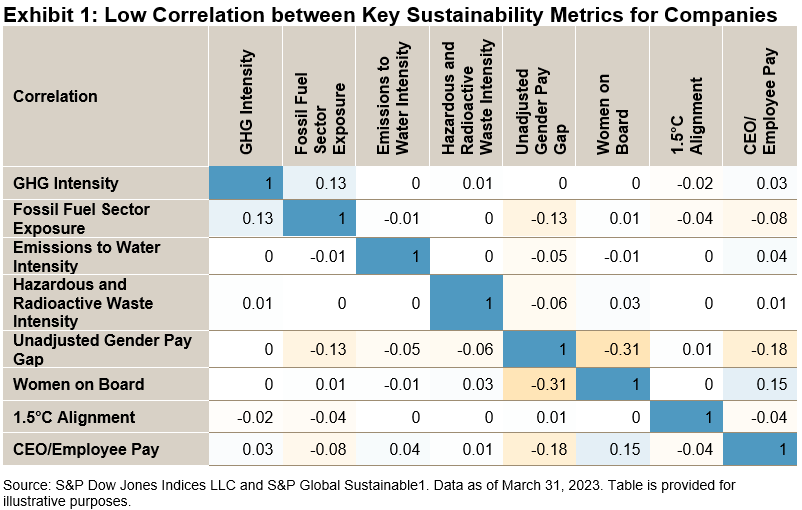

Openness is frequently viewed as an essential principal of sustainable investing, 1 assisting financiers comprehend business’ sustainability profile and sustainable financial investment methods, in addition to possibly adding to financier effect. 2 Sustainability is likewise complex, shown by the distinctions in a number of the Sustainable Advancement Objectives (e.g., no hardship and life listed below water represent extremely various objectives) and mathematically shown by weakly associated, or uncorrelated, business sustainability KPIs (see Exhibition 1).

While dealing with several uncorrelated objectives specifies the sustainability issue well, this raises an obstacle from an index building and openness point of view The easiest techniques are extremely transparent however might do not have capability to record the complex nature of sustainability with accuracy. Additionally, optimization is exceptional at satisfying several goals concurrently; nevertheless, it raises an openness obstacle. We propose tackling this obstacle with our “weight attribution” approach, permitting the finest of both worlds: elegance of index building with openness of weight allowance

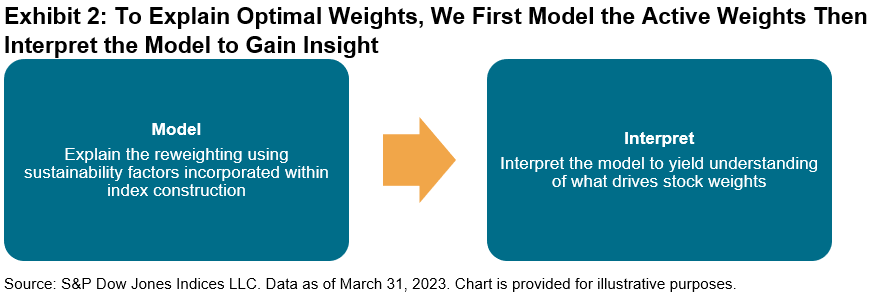

Weight attribution intends to describe active weights within an index, utilizing appropriate information points. This design is analyzed, causing understanding of which elements are affecting stock weights and to what level (see Exhibition 2). 3

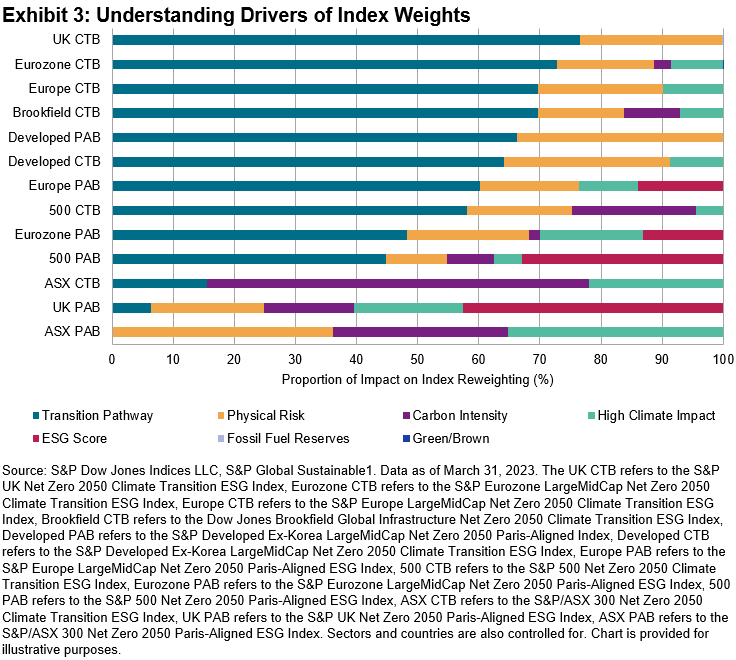

We utilize the S&P PACT ⢠Indices (S&P Paris-Aligned & & Environment Shift Indices) to show openness gains from weight attribution. 7 sustainability metrics are consisted of in the optimization, causing the concern of what truly drives the weights of business. Exhibition 3 reveals the analysis, which yields understanding of the relative significance of sustainability elements when reweighting the indices.

In this example, we see resemblances throughout areas, with the “Shift Path” being the most crucial aspect driving weights. The S&P/ ASX 300 Net No 2050 Environment Shift ESG Index, S&P/ ASX 300 Net No 2050 Paris-Aligned ESG Index and S&P UK Net No 2050 Paris-Aligned ESG Index are various here, where the shift path restraint was softened. We likewise acquire an understanding of how other sustainability elements drove weights of stocks within the indices, offering much required openness to enhanced weights.

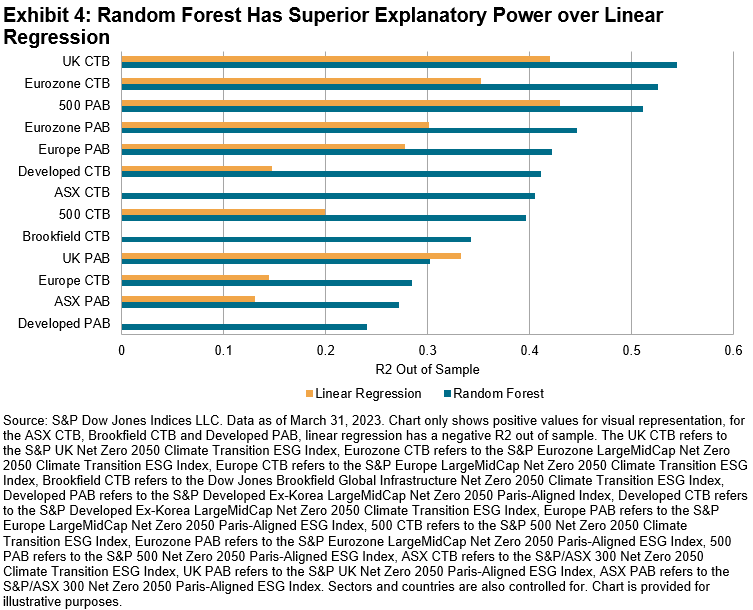

Design choice: in modeling the active weights, the random forest algorithm is chosen over other designs due to the following advantages:

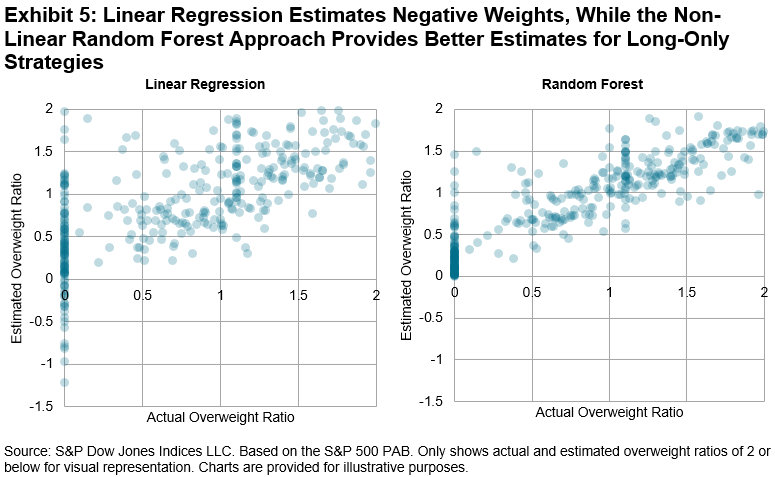

- More powerful explanatory power than direct regression (see Exhibition 4), most likely brought on by the capability to record non-linear relationships in between weights and sustainability elements. In specific, random forest works well for long-only methods, where direct regression forecasts unfavorable weights, which can not be possible (see Exhibition 5);

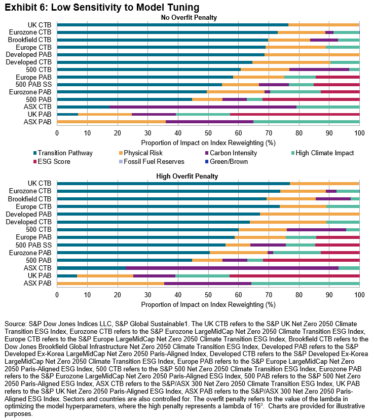

- The result has low level of sensitivity to design tuning (see Exhibition 6) and is less vulnerable to overfitting than other tree-based or non-linear designs; a typical home by style. 4

Weight attribution can bring openness to enhanced indices, which can record the multidimensional nature of sustainability well. This can assist market individuals comprehend sustainable financial investment methods and possibly add to financier effect.

1 Peterson, Douglas L, “ Openness and Effect: The Important Concepts of ESG,” S&P Global, 2022.

2 Kolbel, Heeb, Paetzold and Busch (2020) detail what they think about “determinates of financier effect”. Openness might assist these effect systems.

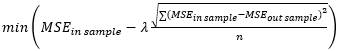

3 The design’s hyperparameters are tuned utilizing a Bayesian optimization, using the following energy function:

Where MSE is the mean square mistake, lambda is a scaling aspect and a 5-k-fold cross-validation is utilized for the out of sample MSE. Design analysis utilizes SHAP worths. SHAP worths intend to comprehend the limited contribution that each function makes to the anticipated result of a design (in the example utilized, the effect a climate/ESG aspect has on the reweighting of stocks within S&P PACT Indices).

4 López de Prado, Marcos, “Advances in Financial Artificial Intelligence,” Wiley, 2018.

The posts on this blog site are viewpoints, not suggestions. Please read our Disclaimers

Integrating Sectors and Sustainability

What takes place to index efficiency and diversity when sectors and sustainability are integrated? S&P DJI’s Stephanie Rowton and Invesco’s Chris Mellor talk about how brand-new index-based tools are assisting market individuals track a varied mix of business with strong sustainability qualifications.

The posts on this blog site are viewpoints, not suggestions. Please read our Disclaimers

S&P/ ASX Small- and Mid-Cap Indices: Differentiators in a Large-Cap Dominated Market

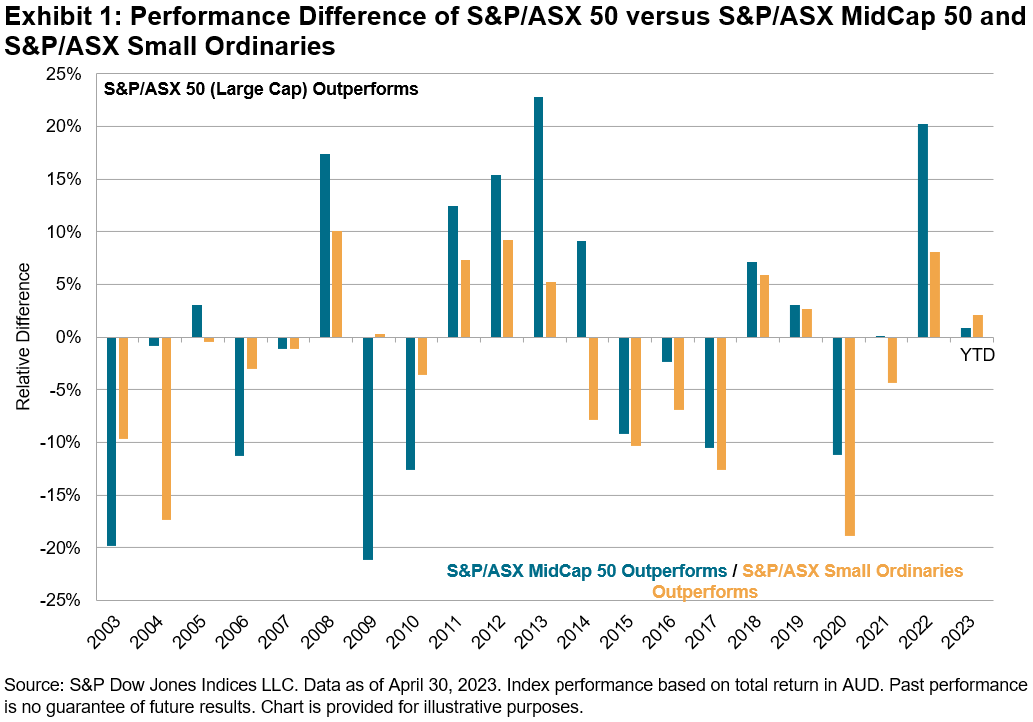

Large-cap, Australian-listed business have actually continued their robust 2022, exceeding the little- and mid-cap sections YTD since April 30, 2023. Nevertheless, a fast-changing financial environment might support thinking about little and mid-cap indices in Australia.

The series of returns for Australian-listed business in 2022 was amongst the largest seen in twenty years. Broad dispersion was displayed throughout sector, design and market cap sections. The fiscal year outperformance of big ( S&P/ ASX 50) versus little- and mid-cap business ( S&P/ ASX Small Ordinaries and S&P/ ASX MidCap 50) was 20.28% and 8.14%, respectively. This is the second-largest outperformance of big versus little and mid-caps over the previous twenty years.

Mid- and Small-Cap Indices Deal Sector Diversity

Financials comprise over 30% of the S&P/ ASX 50 and 5 of its leading 10 business by index weight. The huge 4 banks (CBA, NAB, ANZ and WBC) have actually taken advantage of increasing rate of interest and financier choice for dividend earnings in an inflationary environment. Various sections and sectors might out- or underperform throughout the numerous phases of a financial cycle. As inflationary pressures ease off and rate of interest relatively level out, mid- and small-cap indices might use diversity advantages far from the banks.

Currently, the S&P/ ASX Small Ordinaries has more direct exposure to Customer Discretionary and Realty business, while the S&P/ ASX MidCap 50 has more weight in Industrials and Infotech business relative to the little- and large-cap indices.

Little Caps Deal The Majority Of Engaging Relative Appraisals

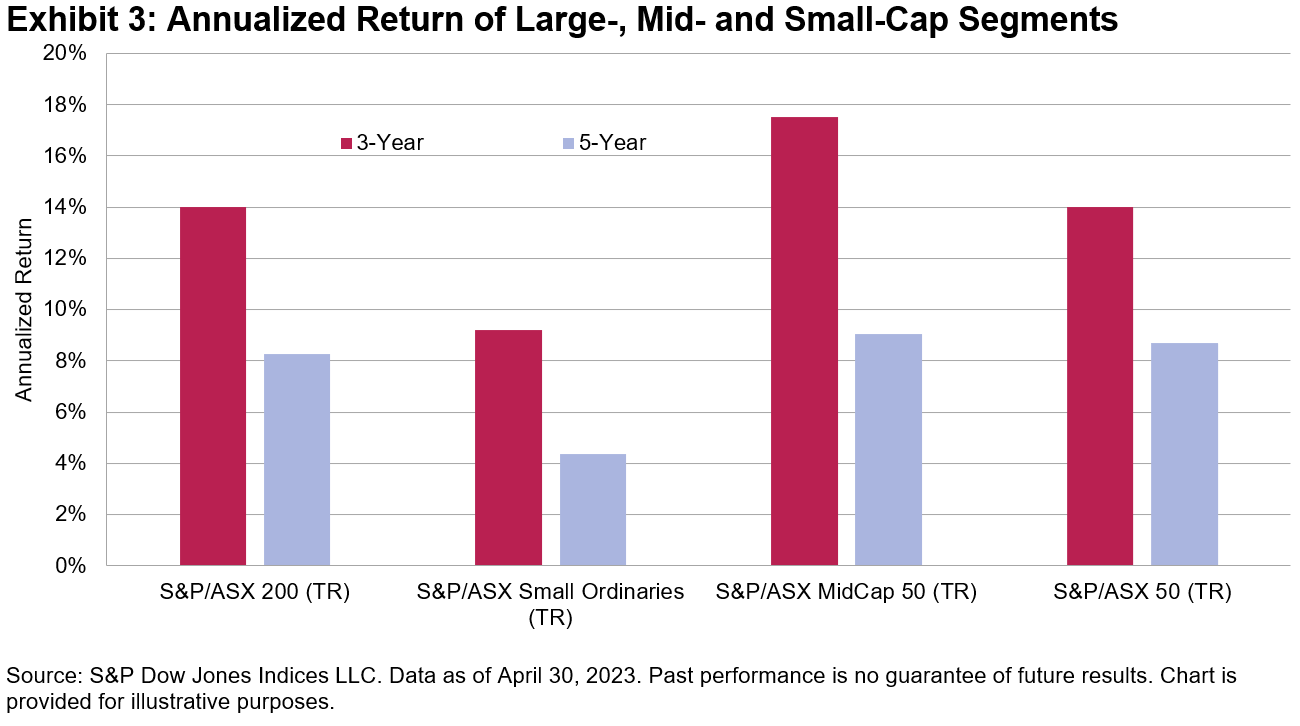

The various structure of the marketplace cap sector indices has actually led to unique efficiency results. Since April 30, 2023, mid-caps were the best-performing market sector over the 3- and five-year durations. The S&P/ ASX Small Ordinaries has actually underperformed throughout this duration, nevertheless, it does display the most engaging relative appraisals.

The tracking 12-month price/earnings ratio for the S&P/ ASX Small Ordinaries and S&P/ ASX Mid Cap 50 are well listed below their long-lasting average, at roughly 9x and 14x incomes, respectively. On the other hand, the three-year average of the 12-month tracking P/E ratio for the S&P/ ASX Small Ordinaries just recently moved lower than the S&P/ ASX 50 for the very first time in over ten years.

Mid- and Small-Cap Active Supervisors Underperformed in 2022

Supporters of active management frequently argue there is more alpha to be discovered in the mid- and small-cap area. In addition, the broad dispersion of returns displayed in 2022 is stated to offer more of a chance set for experienced stock selecting. Nevertheless, S&P DJI’s SPIVA ® Australia Year-End 2022 Scorecard reveals simply 23.4% of Australian Equity Mid- and Small-Cap active funds beat the S&P/ ASX Mid-Small in 2022, while over 80% underperformed on a risk-adjusted basis. Funds in this classification lost 19.8% and 22.0% on equivalent- and asset-weighted bases, respectively, for the exact same duration.

The posts on this blog site are viewpoints, not suggestions. Please read our Disclaimers

The Very Best of Both Worlds: Sustainability in Sectors

Sector-based techniques have actually traditionally revealed they can be important for diversity, to name a few financier objectives, however, previously, sustainability-inclined financiers have actually existed with restricted alternatives With the current production of the S&P ESG Improved Sector Indices and the subsequent licensing of the Infotech, Energy, Financials, and Healthcare indices for a choose series of ETFs in Europe, the capacity for sector-based techniques to sustainable investing has actually increased substantially

In examining such prospective, 2 concerns are natural: initially, what distinction exists in sustainability profile for the ESG improved sectors? Second, what distinction exists in efficiency– especially in the context of a multi-sector allowance? Instinct informs us what to anticipate: while efficiency differentials at the private sector level may be anticipated to be reduced by diversity impacts, we need to anticipate sustainability enhancements to be maintained.

Concentrating on the private sector indices, Displays 1 and 2 summarize their sustainability and efficiency attributes as compared to their benchmark sectors, utilizing the exact same analytical engine driving S&P DJI’s Environment & & ESG Index Control Panel

The 4 S&P ESG Improved Sector Indices attained substantial ESG rating and weighted typical carbon strength (WACI) enhancements versus their criteria, while keeping tracking mistake varies from 1.7% to 3.6%, for the Financials and Energy sector variations, respectively, and comparable annualized returns throughout the complete suite (see Exhibition 3). In addition to enhancements in ESG rating and WACI, these indices likewise attain benchmark-relative improvements in other environment metrics, such as carbon incomes at danger as a % of EBITDA since March 31, 2023.

Exhibition 3 reveals that even the restricted tracking mistake reported in Exhibition 1 mainly counteracted over a longer (back-tested) efficiency horizon, for the entire variety of S&P ESG Improved Sector Indices Over the ten years ending March 2023, the differentials in annualized overall returns varied from -0.1% to 1.8% throughout all 11 ESG improved sectors, with an annualized typical outright distinction of simply 0.5%.

However what about a theoretical multi– sector allowance? To use an illustration, a typical technique is to harness the various danger and efficiency attributes of sectors to browse the marketplace’s cycles. Sectors thought about “protective” are generally chosen in falling markets, while “procyclical” sectors are frequently chosen in increasing markets. To examine the compatibility of ESG improved sectors with such techniques, we built 4 theoretical portfolios, with and without the replacement of chosen ESG variations (see Exhibition 4).

Outcomes for the 4 blends over a years recommend that the replacement of ESG improved sectors did not considerably modify the efficiency profile of the protective and procyclical blends, as revealed by comparable results for mixes with and without the S&P ESG Improved Sector Indices (see Exhibition 5, based upon 10-year returns since March 2023).

Bucketing regular excess returns by months when the S&P Established Ex-Korea LargeMidCap was increasing (up markets) or falling (down markets) even more highlights the compatibility of ESG improved sectors with standard protective and procyclical techniques (see Exhibition 6). In a theoretical combined portfolio, these acted jointly a lot more like standard sector indices, with a tracking mistake of just 2.1% for the Procyclical Blend with ESG and 2.2% for the Protective Blend with ESG. These figures are lower compared to tracking mistake in varieties from 1.7% to 3.6% when ESG improved sectors are thought about in seclusion

In general, these displays display that structure sustainability aspects into sector indices might not always come at the expense of preferred benchmark-like attributes. These indices use the very best of both worlds: an improved sustainability profile with efficiency attributes carefully lined up with standard sector-based index methods, making them a possibly important tool in the financier set. Secret efficiency and sustainability metrics for these indices can be kept an eye on in S&P DJI’s Quarterly Environment & & ESG Index Control Panel

The author wishes to thank Joseph Nelesen for his contributions

GLOSSARY

WACI: Weighted Average Carbon Strength. The index weighted average of private business strengths (Scope 1, Scope 2, Scope 3 upstream and downstream emissions, stabilized with business worth consisting of money).

FFR: Nonrenewable Fuel Source Reserves. The carbon footprint that might be produced if the tested and likely nonrenewable fuel source reserves owned by index constituents were burned per USD 1 million invested.

Monetary Effect of Physical Environment Threat: Monetary losses (e.g., CapEx, OpEx, Service Disruption) showed as a portion of property worth due to direct exposure to climate-related physical dangers throughout situations and period. High Threat Circumstance and 2050 period are utilized for this Exhibition. To find out more, please go to here

Carbon Revenues at Threat as a % of EBITDA: This dataset assists to comprehend and examine the prospective effect to a business’s incomes today if the business needs to pay a future cost for their greenhouse gas emissions. To find out more, please go to here

WAECI: Weighted Average Environmental Expense Strength. This dataset assists to examine the index weighted average of ecological expenses throughout crucial measurements such as carbon emissions, land, water, air toxins, and garbage disposal, natural deposit and water usage. To find out more, please go to here

Board Female Representation (%): The index weighted average of the variety of ladies on a business’s board of directors/supervisory board divided by the overall variety of board directors. To find out more, please go to here

1 Backwards Data Presumption Date: https://www.spglobal.com/spdji/en/education/article/faq-esg-back-testing-backward-data-assumption-overview/

The posts on this blog site are viewpoints, not suggestions. Please read our Disclaimers