{“page”:0,” year”:2023,” monthnum”:6,” day”:1,” name”:” hedging-debt-ceiling-drama-with-the-sp-gsci-sofr-and-sp-gsci-gold”,” mistake”:””,” m”:””,” p”:0,” post_parent”:””,” subpost”:””,” subpost_id”:””,” accessory”:””,” attachment_id”:0,” pagename”:””,” page_id”:0,” 2nd”:””,” minute”:””,” hour”:””,” w”:0,” category_name”:””,” tag”:””,” feline”:””,” tag_id”:””,” author”:””,” author_name”:””,” feed”:””,” tb”:””,” paged”:0,” meta_key”:””,” meta_value”:””,” sneak peek”:””,” s”:””,” sentence”:””,” title”:””,” fields”:””,” menu_order”:””,” embed”:””,” classification __ in”: [],” classification __ not_in”: [],” classification __ and”: [],” post __ in”: [],” post __ not_in”: [],” post_name __ in”: [],” tag __ in”: [],” tag __ not_in”: [],” tag __ and”: [],” tag_slug __ in”: [],” tag_slug __ and”: [],” post_parent __ in”: [],” post_parent __ not_in”: [],” author __ in”: [],” author __ not_in”: [],” search_columns”: [],” ignore_sticky_posts”: incorrect,” suppress_filters”: incorrect,” cache_results”: real,” update_post_term_cache”: real,” update_menu_item_cache”: incorrect,” lazy_load_term_meta”: real,” update_post_meta_cache”: real,” post_type”:””,” posts_per_page”:” 5″,” nopaging”: incorrect,” comments_per_page”:” 50″,” no_found_rows”: incorrect,” order”:” DESC”}

[{“display”:”Craig Lazzara”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/craig_lazzara-353.jpg”,”url”:”https://www.indexologyblog.com/author/craig_lazzara/”},{“display”:”Tim Edwards”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/timothy_edwards-368.jpg”,”url”:”https://www.indexologyblog.com/author/timothy_edwards/”},{“display”:”Hamish Preston”,”title”:”Director, U.S. Equity Indices”,”image”:”/wp-content/authors/hamish_preston-512.jpg”,”url”:”https://www.indexologyblog.com/author/hamish_preston/”},{“display”:”Anu Ganti”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/anu_ganti-505.jpg”,”url”:”https://www.indexologyblog.com/author/anu_ganti/”},{“display”:”Fiona Boal”,”title”:”Managing Director, Global Head of Equities”,”image”:”/wp-content/authors/fiona_boal-317.jpg”,”url”:”https://www.indexologyblog.com/author/fiona_boal/”},{“display”:”Jim Wiederhold”,”title”:”Director, Commodities and Real Assets”,”image”:”/wp-content/authors/jim.wiederhold-515.jpg”,”url”:”https://www.indexologyblog.com/author/jim-wiederhold/”},{“display”:”Phillip Brzenk”,”title”:”Managing Director, Global Head of Multi-Asset Indices”,”image”:”/wp-content/authors/phillip_brzenk-325.jpg”,”url”:”https://www.indexologyblog.com/author/phillip_brzenk/”},{“display”:”Howard Silverblatt”,”title”:”Senior Index Analyst, Product Management”,”image”:”/wp-content/authors/howard_silverblatt-197.jpg”,”url”:”https://www.indexologyblog.com/author/howard_silverblatt/”},{“display”:”Michael Orzano”,”title”:”Senior Director, Global Equity Indices”,”image”:”/wp-content/authors/Mike.Orzano-231.jpg”,”url”:”https://www.indexologyblog.com/author/mike-orzano/”},{“display”:”John Welling”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/john_welling-246.jpg”,”url”:”https://www.indexologyblog.com/author/john_welling/”},{“display”:”Wenli Bill Hao”,”title”:”Senior Lead, Strategy Indices”,”image”:”/wp-content/authors/bill_hao-351.jpg”,”url”:”https://www.indexologyblog.com/author/bill_hao/”},{“display”:”Maria Sanchez”,”title”:”Director, Sustainability Indices Product Management, Latin America”,”image”:”/wp-content/authors/maria_sanchez-243.jpg”,”url”:”https://www.indexologyblog.com/author/maria_sanchez/”},{“display”:”Shaun Wurzbach”,”title”:”Managing Director, Head of Commercial Group (North America)”,”image”:”/wp-content/authors/shaun_wurzbach-200.jpg”,”url”:”https://www.indexologyblog.com/author/shaun_wurzbach/”},{“display”:”Silvia Kitchener”,”title”:”Director, Global Equity Indices, Latin America”,”image”:”/wp-content/authors/silvia_kitchener-522.jpg”,”url”:”https://www.indexologyblog.com/author/silvia_kitchener/”},{“display”:”Akash Jain”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/akash_jain-348.jpg”,”url”:”https://www.indexologyblog.com/author/akash_jain/”},{“display”:”Ved Malla”,”title”:”Associate Director, Client Coverage”,”image”:”/wp-content/authors/ved_malla-347.jpg”,”url”:”https://www.indexologyblog.com/author/ved_malla/”},{“display”:”Rupert Watts”,”title”:”Senior Director, Strategy Indices”,”image”:”/wp-content/authors/rupert_watts-366.jpg”,”url”:”https://www.indexologyblog.com/author/rupert_watts/”},{“display”:”Jason Giordano”,”title”:”Director, Fixed Income, Product Management”,”image”:”/wp-content/authors/jason_giordano-378.jpg”,”url”:”https://www.indexologyblog.com/author/jason_giordano/”},{“display”:”Qing Li”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/qing_li-190.jpg”,”url”:”https://www.indexologyblog.com/author/qing_li/”},{“display”:”Ben Leale-Green”,”title”:”Associate Director, Research & Design, ESG Indices”,”image”:”/wp-content/authors/ben_leale-green-342.jpg”,”url”:”https://www.indexologyblog.com/author/ben_leale-green/”},{“display”:”Sherifa Issifu”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/sherifa_issifu-518.jpg”,”url”:”https://www.indexologyblog.com/author/sherifa_issifu/”},{“display”:”Brian Luke”,”title”:”Senior Director, Head of Commodities and Real Assets”,”image”:”/wp-content/authors/brian.luke-509.jpg”,”url”:”https://www.indexologyblog.com/author/brian-luke/”},{“display”:”Glenn Doody”,”title”:”Vice President, Product Management, Technology Innovation and Specialty Products”,”image”:”/wp-content/authors/glenn_doody-517.jpg”,”url”:”https://www.indexologyblog.com/author/glenn_doody/”},{“display”:”Priscilla Luk”,”title”:”Managing Director, Global Research & Design, APAC”,”image”:”/wp-content/authors/priscilla_luk-228.jpg”,”url”:”https://www.indexologyblog.com/author/priscilla_luk/”},{“display”:”Liyu Zeng”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/liyu_zeng-252.png”,”url”:”https://www.indexologyblog.com/author/liyu_zeng/”},{“display”:”Barbara Velado”,”title”:”Senior Analyst, Research & Design, Sustainability Indices”,”image”:”/wp-content/authors/barbara_velado-413.jpg”,”url”:”https://www.indexologyblog.com/author/barbara_velado/”},{“display”:”Sean Freer”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/sean_freer-490.jpg”,”url”:”https://www.indexologyblog.com/author/sean_freer/”},{“display”:”Benedek Vu00f6ru00f6s”,”title”:”Director, Index Investment Strategy”,”image”:”/wp-content/authors/benedek_voros-440.jpg”,”url”:”https://www.indexologyblog.com/author/benedek_voros/”},{“display”:”Cristopher Anguiano”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/cristopher_anguiano-506.jpg”,”url”:”https://www.indexologyblog.com/author/cristopher_anguiano/”},{“display”:”Michael Mell”,”title”:”Senior Director, Custom Indices”,”image”:”/wp-content/authors/michael_mell-362.jpg”,”url”:”https://www.indexologyblog.com/author/michael_mell/”},{“display”:”Andrew Innes”,”title”:”Head of EMEA, Global Research & Design”,”image”:”/wp-content/authors/andrew_innes-189.jpg”,”url”:”https://www.indexologyblog.com/author/andrew_innes/”},{“display”:”Rachel Du”,”title”:”Senior Analyst, Global Research & Design”,”image”:”/wp-content/authors/rachel_du-365.jpg”,”url”:”https://www.indexologyblog.com/author/rachel_du/”},{“display”:”Izzy Wang”,”title”:”Analyst, Strategy Indices”,”image”:”/wp-content/authors/izzy.wang-326.jpg”,”url”:”https://www.indexologyblog.com/author/izzy-wang/”},{“display”:”George Valantasis”,”title”:”Associate Director, Strategy Indices”,”image”:”/wp-content/authors/george-valantasis-453.jpg”,”url”:”https://www.indexologyblog.com/author/george-valantasis/”},{“display”:”Eduardo Olazabal”,”title”:”Senior Analyst, Global Equity Indices”,”image”:”/wp-content/authors/eduardo_olazabal-451.jpg”,”url”:”https://www.indexologyblog.com/author/eduardo_olazabal/”},{“display”:”Jason Ye”,”title”:”Director, Strategy Indices”,”image”:”/wp-content/authors/Jason%20Ye-448.jpg”,”url”:”https://www.indexologyblog.com/author/jason-ye/”},{“display”:”Fei Wang”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/fei_wang-443.jpg”,”url”:”https://www.indexologyblog.com/author/fei_wang/”},{“display”:”Jaspreet Duhra”,”title”:”Managing Director, Global Head of Sustainability Indices”,”image”:”/wp-content/authors/jaspreet_duhra-504.jpg”,”url”:”https://www.indexologyblog.com/author/jaspreet_duhra/”},{“display”:”Joseph Nelesen”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/joseph_nelesen-452.jpg”,”url”:”https://www.indexologyblog.com/author/joseph_nelesen/”},{“display”:”Ari Rajendra”,”title”:”Senior Director, Head of Thematic Indices”,”image”:”/wp-content/authors/Ari.Rajendra-524.jpg”,”url”:”https://www.indexologyblog.com/author/ari-rajendra/”},{“display”:”Louis Bellucci”,”title”:”Senior Director, Index Governance”,”image”:”/wp-content/authors/louis_bellucci-377.jpg”,”url”:”https://www.indexologyblog.com/author/louis_bellucci/”},{“display”:”Daniel Perrone”,”title”:”Director and Head of Operations, ESG Indices”,”image”:”/wp-content/authors/daniel_perrone-387.jpg”,”url”:”https://www.indexologyblog.com/author/daniel_perrone/”},{“display”:”Raghu Ramachandran”,”title”:”Head of Insurance Asset Channel”,”image”:”/wp-content/authors/raghu_ramachandram-288.jpg”,”url”:”https://www.indexologyblog.com/author/raghu_ramachandram/”},{“display”:”Narottama Bowden”,”title”:”Director, ESG Index Intelligence, Index Governance”,”image”:”/wp-content/authors/narottama_bowden-331.jpg”,”url”:”https://www.indexologyblog.com/author/narottama_bowden/”},{“display”:”Lalit Ponnala”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/lalit.ponnala-388.jpg”,”url”:”https://www.indexologyblog.com/author/lalit-ponnala/”}]

Hedging Financial Obligation Ceiling Drama with the S&P GSCI SOFR and S&P GSCI Gold

The financial obligation ceiling argument in Washington seems nearing an end. According to the U.S. Treasury, Congress has “constantly acted when hired” and markets will try to find them to do so for the 79 th time this month. By index guideline, all products in the S&P GSCI are sold U.S. dollars, so the significance and respect to the “world’s reserve currency” rings real whenever a futures agreement on the S&P GSCI is settled.

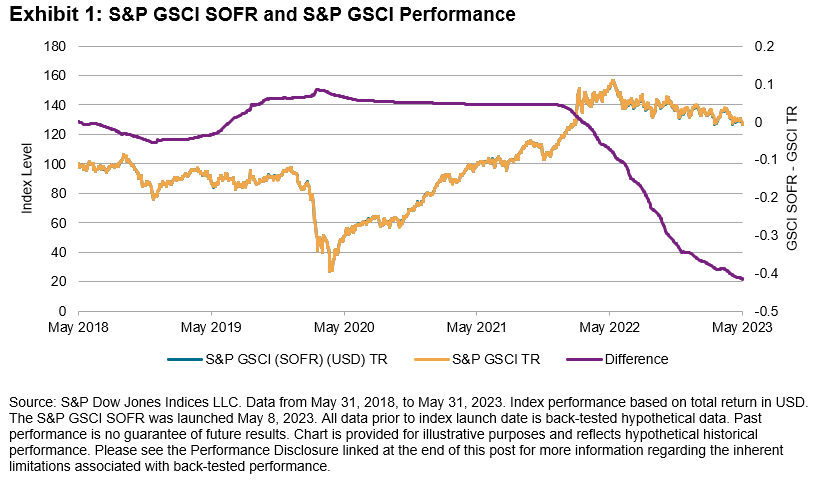

The S&P GSCI SOFR released in May and leverages the very same index building and computation concepts as the S&P GSCI, however uses the Guaranteed Overnight Funding Rate (SOFR) into the computation rather of Treasury Costs. Utilizing SOFR in lieu of Treasury Costs enables efficiency tracking with alternative money management techniques. Consisting of rates that are collateralized by Treasury securities, there is still direct exposure to the faith and credit of the U.S. federal government. Nevertheless, it omits particular deals that are considered to be trading “unique,” or at a rate outside the basic market activity. The SOFR is released daily by the U.S. Federal Reserve and can be discovered on its site. As SOFR volumes increase, the capability to have a complementary index enables possibly enhanced money management abilities through money and acquired instruments.

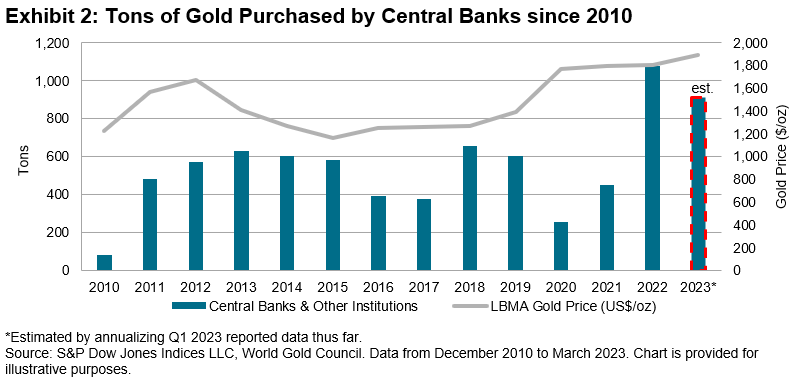

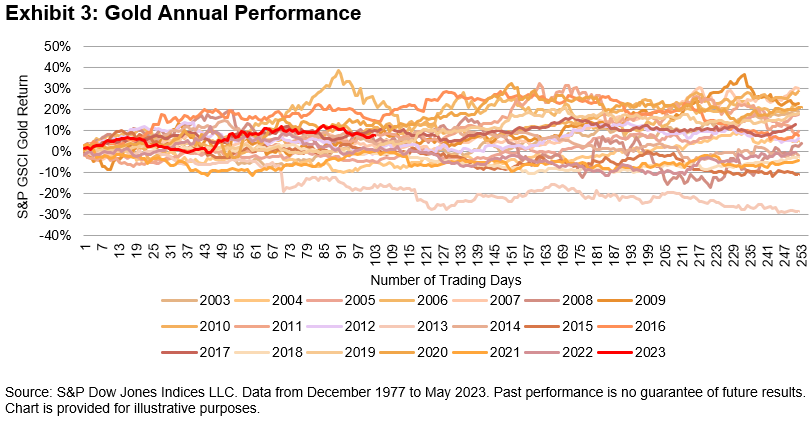

Gold has actually long functioned as the option to fiat currency when there is issue in the market relating to the political outlook. With this year’s argument, the S&P GSCI Gold has actually traded near its all-time high and has actually outshined broad products by over 18%. While fiat cash can, and likely will, continue to be printed, the international production of gold is reasonably flat at simply 1% -2% of overall supply. Reserve banks have actually bought gold at rates not seen considering that the U.S. federal government broke its gold requirement in 1971. Consistent supply produces a reasonably repaired base for the metal, while need is mainly driven by a few of the biggest holders of U.S. federal government financial obligation: international reserve banks.

Biggest Reserve Bank Purchases in 50 Years

Given that striking a YTD high of 12%, the S&P GSCI Gold has actually kipped down strong, if not magnificent, outcomes. Appeal has actually increased due to the current financial obligation ceiling arguments, and in spite of political leaders pertaining to an option that would prevent default, main lenders seem stockpiling.

The posts on this blog site are viewpoints, not guidance. Please read our Disclaimers

Cutting Carbon without Altering Course: Net No Fixed Earnings Indices

Maya Beyhan

Senior Director, ESG Professional, Index Financial Investment Method

S&P Dow Jones Indices

S&P DJI just recently broadened its variety of S&P PACT ⢠Indices (S&P Paris-Aligned & & Environment Shift Indices) to exceed equity to now cover set earnings. Within these indices, the distinctions in between the 2 property classes in regards to the balance in between expense (tracking mistake) and benefit (sustainability profile) are material and extremely thought-provoking.

As displayed in S&P DJI’s Environment & & ESG Index Control Panel, the equity S&P PACT Indices normally have actually an annualized tracking mistake varying from 1.8% to 2.7% versus their market-cap-weighted standards since March 31, 2023. These levels of tracking mistake might be challenging for financiers who are extremely conscious any discrepancies in efficiency from a requirement, market-cap-weighted criteria.

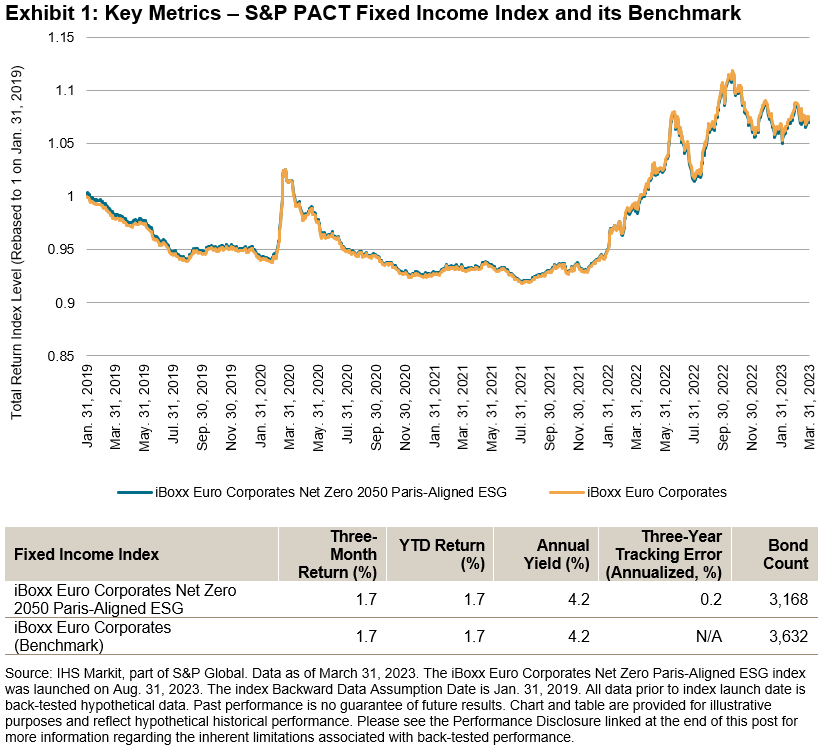

Following on the course drawn by equity indices, the suite of S&P PACT Indices broadened into set earnings with the launch of the iBoxx EUR Corporates Net No 2050 Paris-Aligned ESG This index utilizes the broad iBoxx EUR Corporates as its underlying criteria and embraces likewise enthusiastic sustainability and environment targets as its equity equivalent– in specific, satisfying the meaning of a Paris-Aligned criteria.

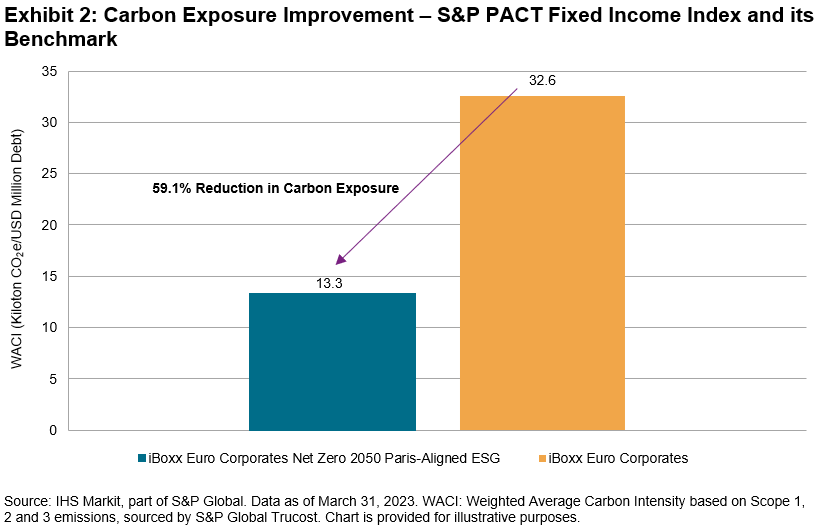

What is especially impressive about this set earnings S&P PACT Index is that it has had actually a (back-tested) yearly tracking mistake of only 0.2% versus its hidden index; particularly, it has actually accomplished a product benchmark-relative decrease in carbon direct exposure of 59.1% since March 31, 2023. Displays 1 and 2 sum up the carbon direct exposure enhancement and efficiency attributes as compared to iBoxx EUR Corporates, utilizing the very same analytical engine driving S&P DJI’s Environment & & ESG Index Control Panel.

In general, these exhibitions reveal that the set earnings S&P PACT Index preserved near benchmark-like efficiency while accomplishing a significant enhancement in carbon direct exposure.

The essential to this outcome is that, while incorporating sustainability and environment objectives, the set earnings approach for the S&P PACT Indices likewise consists of actions to approximate the period and credit quality of the criteria. With a comparable score and maturity profile, even enthusiastic sustainability and environment objectives can possibly be included without producing materially unique index efficiency. For this factor, the set earnings S&P PACT Index might work to those who are extremely conscious tracking mistake, lining up with environment and sustainability objectives at a limited expense.

Secret efficiency and sustainability metrics for the S&P PACT Index suite can be kept track of in S&P DJI’s Quarterly Environment & & ESG Index Control Panel

1 https://www.spglobal.com/spdji/en/education/article/faq-esg-back-testing-backward-data-assumption-overview/

The posts on this blog site are viewpoints, not guidance. Please read our Disclaimers

A Glance at Secret USD Indices and Fixed Earnings ETF Streams This Year

2022 marked a complete year of rate walkings, extraordinary considering that the Global Financial Crisis, which moved short-term yields up and in turn eventually triggered the 10-2 spread 1 to fall listed below no in the 2nd half of 2022, where it has actually considering that remained. Current market expectations recommend that completion of rate increases is maybe in sight as we begin to see its effect on a couple of U.S. local banks along with the forced takeover of among Europe’s biggest banks– Credit Suisse– previously this year. While the most recent U.S. inflation numbers have actually relieved, work information continues to recommend a strong labor market. It’s anybody’s guess whether the Fed will move rates in June.

Index Efficiency

Let us have a look at the efficiency of essential USD indices in 2022, and 2023 YTD. Afterwards, we will check out how the index efficiency might have affected ETFs streams in their particular classifications up until now this year.

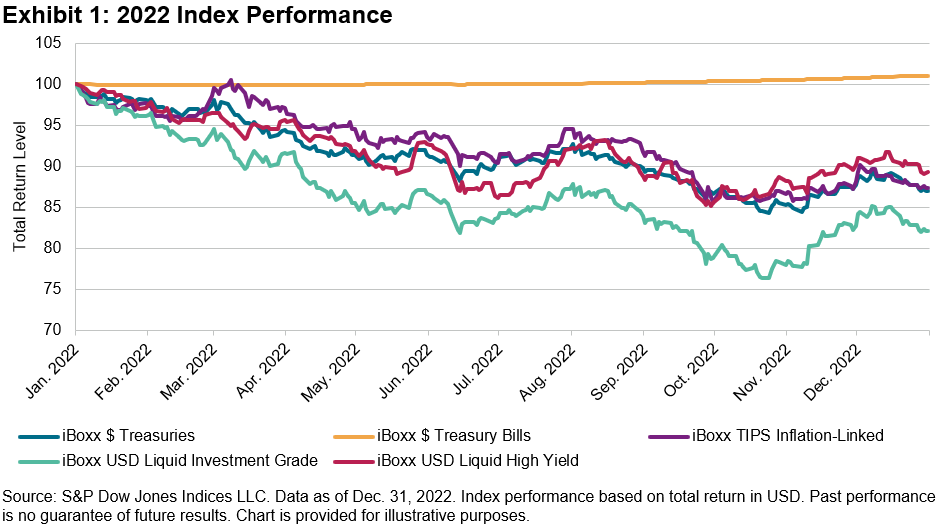

As can be seen in the chart above, 2022 was a quite depressing year for USD set earnings, with the numerous rate walkings depressing the worth of bonds, particularly the longer tenors. The only index that was not negatively impacted by the rates of interest motions was the short-dated iBoxx $ Treasury Costs, which determines the efficiency of U.S. federal government costs with maturities of one year or less.

The worst-performing section was high quality business bonds, as represented by the iBoxx USD Liquid Financial investment Grade. The index was down 17.9% in 2022.

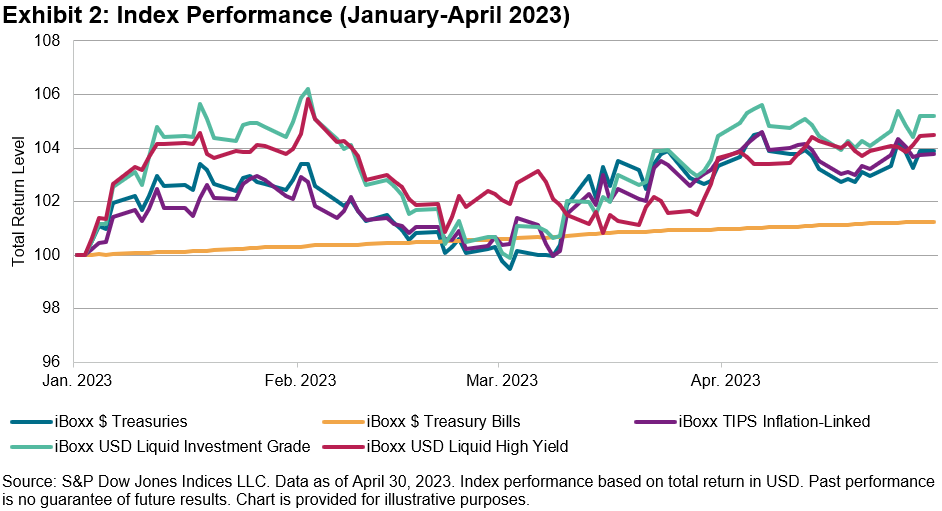

It has actually been an entirely various story considering that the start of 2023; all of these included indices are back in the black, led by the iBoxx USD Liquid Financial investment Grade with a YTD return of 5.2% (since April 30, 2023), surpassing short-term treasury costs and other U.S. federal government securities.

The favorable efficiency accompanied market belief that we might be nearing completion of the rate walkings, which might have triggered financiers to begin moving far from short-term bonds into longer-tenure bonds with a focus on credit quality.

ETF Streams

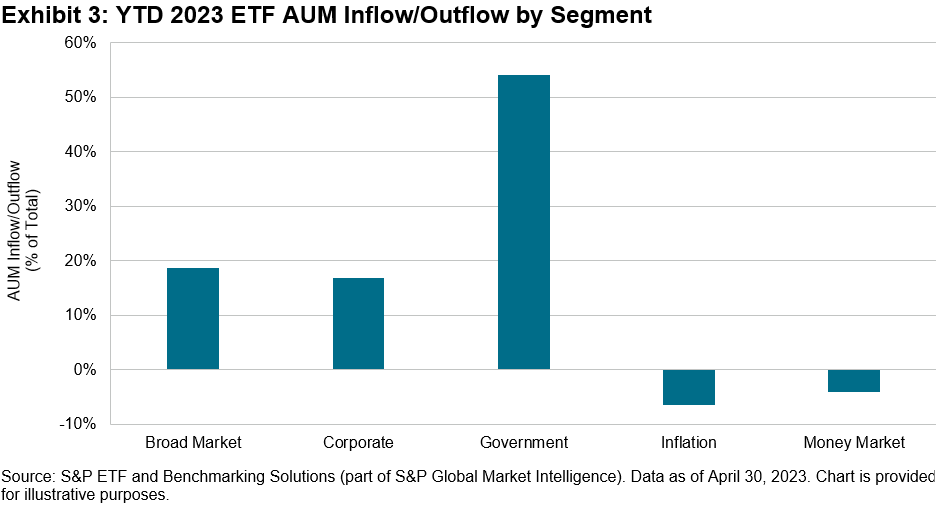

As portrayed in Display 3, financiers have actually apparently started to move far from inflation and cash market items this year, with most of the circulations moving into U.S. federal government bonds. Despite the fact that business financial investment grade bonds carried out much better than U.S. Treasuries (as seen in Display 2), financiers might still beware of the general financial outlook and hence choose the safe house of a reasonably safe property over business financial investment grade bonds.

Since April 30, 2023, U.S. Treasuries– as represented by the iBoxx $ Treasuries– used a yield of 3.73% with a yearly customized period of 6.35 years, while U.S. financial investment grade bonds– as represented by the iBoxx $ Liquid Financial investment Grade– used a yield of 5.17% with a yearly customized period of 8.36 years.

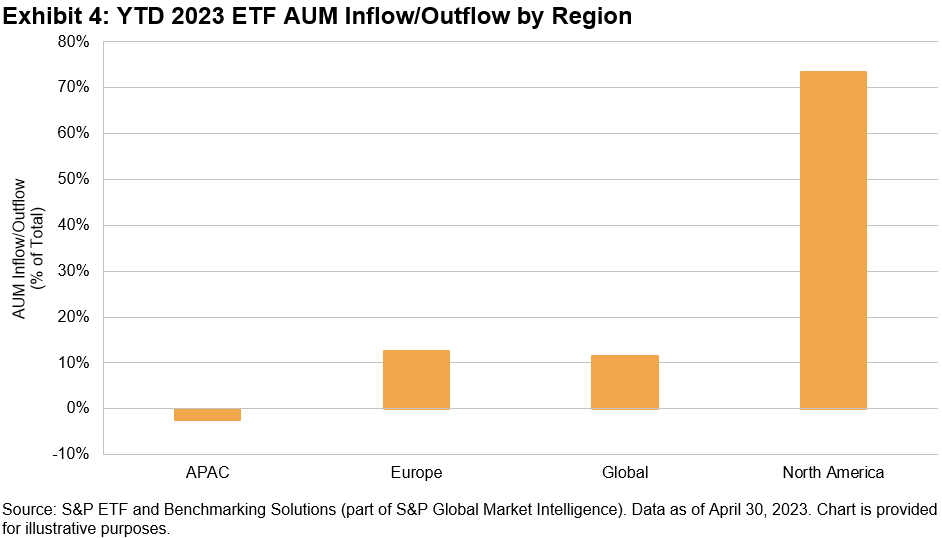

It is maybe of not a surprise that most of the AUM circulations were directed into U.S. set earnings ETFs, provided their supremacy and market share in the general ETF market. There has actually likewise been a little outflow from APAC ETFs up until now this year, maybe due to the choice for high quality bonds and greater yields in overseas markets compared to lower regional currency yields in particular APAC markets.

Brief- or Longer-Term Investments Today?

In a theoretical situation, if one were to buy a longer-term mutual fund today and rates pull away over the next number of years, the roi might be greater than the “used yield” today due to capital gratitude of the bonds. This is because of the inverted relationship in between bond costs and yields (as yields decrease, bond costs increase).

As we may be approaching completion of the rate walkings, will we see a continual shift towards medium-to-long outdated bonds in the future?

1 Source: Federal Reserve Bank of St. Louis

The posts on this blog site are viewpoints, not guidance. Please read our Disclaimers

Constantly Frustrating

-

Classifications

Equities, S&P 500 & & DJIA -

Tags

active management, Active vs. Passive, Craig Lazzara, index efficiency, institutional financier, passive investing, passive management, Perseverance, S&P 500, Ability vs. Luck, SPIVA, (* )&United States FA If you have actually ever check out a prospectus( or, for that matter, an S&P DJI research study report ), you understand that” previous efficiency is no assurance of future outcomes.” At one level, if you comprehend that, you comprehend the most crucial thing&about S&P DJI’s Perseverance Scorecards. For the

U.S., Europe, Latin America, and Canada( with Australia coming quickly!) our just recently launched Perseverance Scorecards are consentaneous in revealing that historic outperformance is not a predictor of future outperformance At a much deeper level, why do we care? We understand from

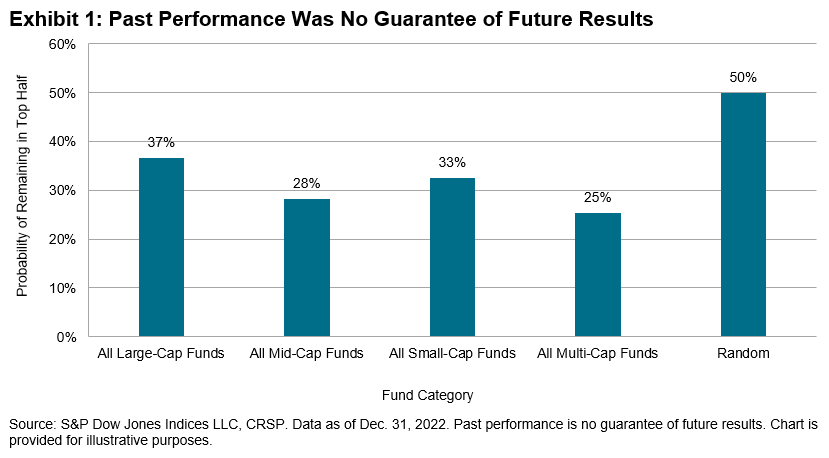

SPIVA ®(* )and other information that most active supervisors underperform the majority of the time. However even in the most difficult years, there is a series of active efficiency outcomes; some supervisors will constantly do much better than others, despite the number of outperform passive standards like the S&P 500 ® Do the leading entertainers arrive since of real ability or simply since of best of luck? There is, after all, no faith that prevents the presence of a (probably little) subset of really experienced active supervisors. If such a group existed, how would their capabilities be evidenced in efficiency information? As an idea experiment, we can think about a theoretical set of supervisors who attain above-median efficiency in a specific duration, and ask how they carry out in subsequent durations. If every above-median supervisor in duration one arrived merely by being fortunate, we would anticipate half of them to be above typical once again in duration 2. If the repeat-success rate were considerably above 50%, we may start to presume that the above-median supervisors were really experienced. However if less than 50% of the duration one successes were above typical in duration 2, that would support the view that their duration one success was because of luck.

If we comprehend something about determination, we might have the ability to make reasonings about supervisor ability.

Which is precisely what the Perseverance Scorecards let us do. Display 1 highlights, utilizing ten years of U.S. equity information and asking to what degree above-median efficiency in the very first 5 years forecasted above-median efficiency in the 2nd 5 years. The response is: not. In every fund classification, the winners in years 1-5 were not likely to duplicate their success in years 6-10. There are, naturally, other methods to check for determination. We might analyze efficiency relative to a criteria instead of to a peer group, with various lookback durations (one year or 3 years instead of 5 years), with various cutoffs (quartiles instead of halves), and for various property classes (bonds along with stocks). Our Perseverance Scorecards do all of these things and,

mutatis mutandis

, the outcomes are the very same. Outcomes produced by real ability are most likely to continue, while those due to luck are most likely to show ephemeral

The information recommend that great active efficiency frequently owes more to luck than to ability. The posts on this blog site are viewpoints, not guidance. Please read our Disclaimers

Classifications Equities,

Senior Director, Index Financial Investment Method

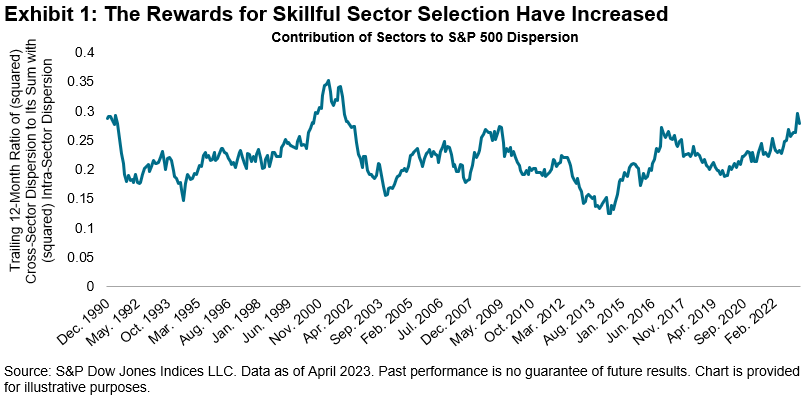

The current market environment might similarly well be defined as a sector picker’s market To determine the significance of sectors, we decay overall market dispersion

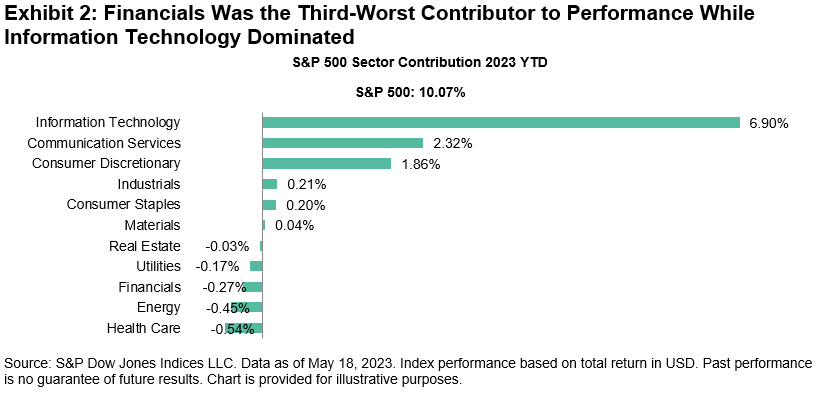

into within-sector and cross-sector results. Display 1 reveals that the contribution of cross-sector results to overall S&P 500 ® dispersion has actually trended up this year, indicating that the benefits for experienced sector choice have actually increased. The current travails of the banking market

have actually damaged the Financials sector, with the S&P 500 Financials down 4% YTD since Might 18, 2023. On the other hand, the general market has actually marched to a various drumbeat, with the S&P 500 up 10%. As Display 2 highlights, the Financials sector was the third-biggest critic from S&P 500 efficiency, while Infotech was the dominant factor YTD. As an outcome, financiers who overweighted Infotech or underweighted Financials would have been well rewarded, with the S&P 500 Ex-Financials

up 12% YTD. Nevertheless, it deserves keeping in mind that the outperformance of IT has actually been much higher than the underperformance of Financials, with the S&P 500 Infotech up 28% YTD. As sectors progress in time, so does their diversity capacity. As we formerly checked out for

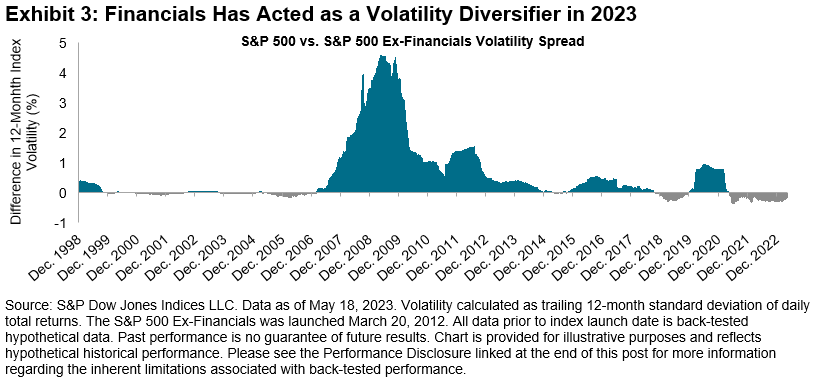

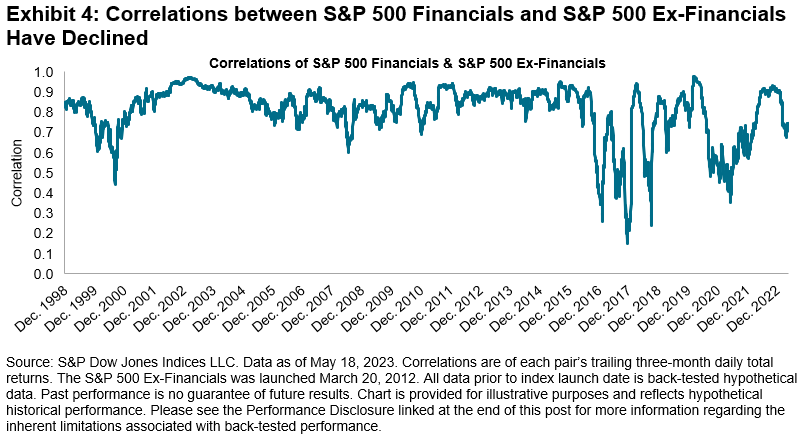

Energy and Infotech, in Display 3, we compute the spread in tracking 12-month volatility in between the S&P 500 and the S&P 500 Ex-Financials. When this spread is favorable, the addition of Financials increases volatility in the criteria; when unfavorable, the sector functions as a diversifier. Keep in mind the unfavorable spread for Financials up until now this year. The Financials sector has actually ended up being a volatility diversifier since its connection with the remainder of the market has actually just recently decreased, as displayed in Display 4. While the Financials sector has actually just recently lowered volatility, this hasn’t constantly held true. For instance, throughout the depths of the 2008 Global Financial Crisis, the Financials sector was a significant source of volatility. Regardless of the sector’s failing relative efficiency up until now this year, its present danger positioning

may possibly show advantageous for cautious sector allocators.

The posts on this blog site are viewpoints, not guidance. Please read our Disclaimers