Here’s some great news for financiers stressing over what guarantees to be an extremely controversial 2024 U.S. governmental election: History reveals stocks tend to rally in the year before Election Day.

However there’s a rub, kept in mind Saira Malik, primary financial investment officer at Nuveen, which has $1.2 trillion in properties under management: While the S&P 500

SPX

has actually seen a typical overall return of around 10% in governmental election years based upon information returning to 1928, the large-cap criteria had actually currently rallied by more than that in between early November and completion of in 2015.

Simply put, those pre-election gains might have currently took place.

” That’s type of a fascinating figure and among the numerous factors we’re a bit more worried about equities entering the start of 2024,” Malik informed MarketWatch in a phone interview.

Nuveen.

Those other factors consist of a propensity for markets to be more unstable in election years, in addition to issues that financiers are still pricing in more rate of interest cuts than the Federal Reserve is most likely to provide, Malik stated. Likewise, stocks are costly, with the S&P 500 trading at about a 20% premium to its typical assessment considering that 2010, she kept in mind.

Financiers likewise understand the 2024 election is most likely to be extremely controversial. Donald Trump heads into Tuesday’s Republican main as the clear front-runner for his celebration’s election as he looks for a November rematch with President Joe Biden.

Washington Watch: New Hampshire GOP primary: Haley attempts to turn the tide, as Trump cruises towards the 2024 election

Trump is campaigning amidst various legal problems. Trump deals with charges in Washington, D.C., and Georgia’s Fulton County in election-interference cases and was prosecuted in 2015 in a hush-money case and a classified-documents case He has actually rejected misbehavior and argued the prosecutions are politically encouraged, while duplicating incorrect claims about his 2020 election loss.

Biden deals with low approval scores, consisting of within his own celebration. An ABC News survey today discovered 57% of Democrats and Democrat-leaning independents would be pleased with a Biden election, while 72% of Republican-aligned grownups would be pleased with having Trump as their celebration’s candidate.

On the other hand, concerns over U.S. political dysfunction are on the increase. In 2015’s federal debt-ceiling face-off and the subsequent ouster of Kevin McCarthy from his post as speaker of your home highlighted issues amongst some financiers that self-confidence in U.S. organizations and governance was starting to deteriorate.

See: What U.S. political dysfunction suggests for the stock exchange and financiers

As the election approaches, a progressively controversial political background might be a dish for greater market volatility. An objected to election outcome, might drive that volatility even greater, Malik stated.

Governmental election years likewise indicate financiers must be gotten ready for an avalanche of charts and tables examining historic market efficiency around the quadrennial occasion.

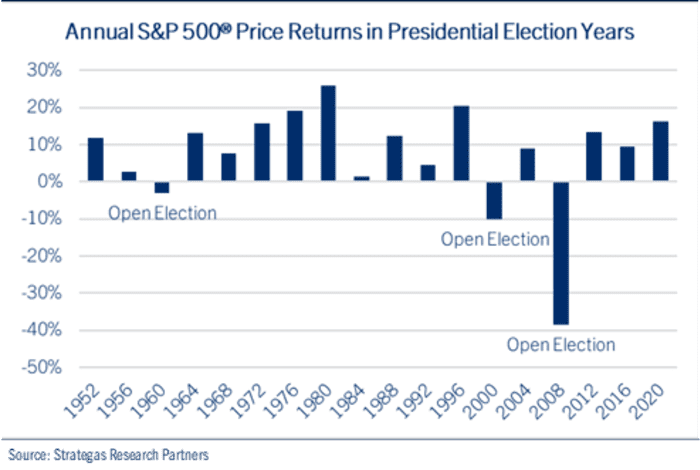

Acknowledging the “danger of a jinx,” John Lynch, primary financial investment officer at Comerica Wealth Management, highlighted the one listed below revealing that stocks have actually never ever published an annual decrease when an incumbent president– win or lose– ran for re-election. That consists of 2020, when stocks suffered a February-March crash set off by the start of the COVID-19 pandemic, however quickly recuperated to publish an annual gain.

Strategas Research Study Partners.

Returning to 1952, the index has actually suffered an annual fall in an election year just 3 times– 1960, 2000 and 2008. All 3 were years were “open” election years, without any incumbent running for re-election, Lynch kept in mind.

Still, the efficiency of the marketplace, in as far as it shows the economy, might likewise be outlining a prospect’s potential customers. Lynch kept in mind that every president who handled to prevent economic crisis in the 2 years before their re-election went on to win a 2nd term, while every president that experienced economic crisis because stretch wound up losing.

He kept in mind that stocks normally exceed in governmental election years when the incumbent wins. After all, a strong economy and market most likely methods citizen belief lags the sitting president.

The pattern in years when incumbents lose, on the other hand, tends to include a set of selloffs, one throughout the height of main season in early spring and another following the celebration conventions in late summer season.

That’s left the stock exchange with apparently strong predictive power, Lynch stated.

In 24 governmental elections considering that 1928, the instructions of the index has actually telegraphed the election result, Lynch stated, pointing out information from Strategas. If the S&P 500 was favorable in the 3 months leading up to the election, the incumbent or the prospect of the incumbent’s celebration won. Of the 4 times the indication was inaccurate, the index increased however the incumbent celebration’s prospect still lost.

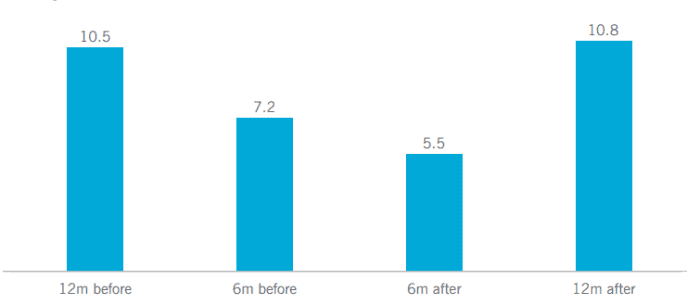

U.S. stocks saw a strong rally in 2023, in keeping with the so-called governmental cycle that normally sees strong gains in the 3rd year of a president’s term. Equities combined to start the brand-new year, however ended up recently on a strong note, with the S&P 500 logging its very first record close in more than 2 years.

See: After S&P 500’s brand-new record high, here’s what history states might take place next

The Dow Jones Industrial Average.

DJIA

likewise logged a record close, increasing 0.7% for the week, while the Nasdaq Composite.

COMPENSATION

saw a 2.3% weekly advance as tech shares reasserted their management.

The strong tech efficiency, on the other hand, might show issues about the remaining power of the customer, stated Nuveen’s Malik. The company competes the mix of cyclical danger and politically influenced volatility uses a case for playing defense.

That consists of concentrating on stocks of dividend growers– business that have actually regularly raised their dividends in time– in addition to international facilities plays that stand to see more gain from patterns preferring reshoring, nearshoring and other modifications to provide chains.

Dividend-growth and international facilities stocks have actually traditionally weathered down markets fairly well, Malik stated, stressing Nuveen’s issues about the capacity for a drawdown following the “incredibly strong” equity rally seen over the last 2 months of 2023.