Introduction.

The electrification shift is well in progress and has actually stimulated a development in need for base metals, consisting of nickel and copper, which most tidy innovations need. The total belief for these metals continues to be healthy and positive, even in the middle of worldwide financial chaos.

Australia is supporting this development in need through its mining-friendly, tier-1 jurisdictions The nation is a world leader in producing and exporting a myriad of metals and minerals, consisting of iron, copper, lithium, nickel, bauxite and gold. In general, Australia produces considerable quantities of 19 sought-after minerals from more than 350 operating mines Australia’s Musgrave Province consists of a Mesoproterozoic crystalline basement surface that reaches throughout the shared borders of Western Australia, the Northern Area and South Australia. The surface has considerable deposits of a number of important metals, consisting of nickel, platinum group components (PGEs), copper, gold, lead, zinc, chromite, and uncommon earth components (REEs). Yet, much of Musgrave stays underexplored, particularly for the base metals the world now requires.

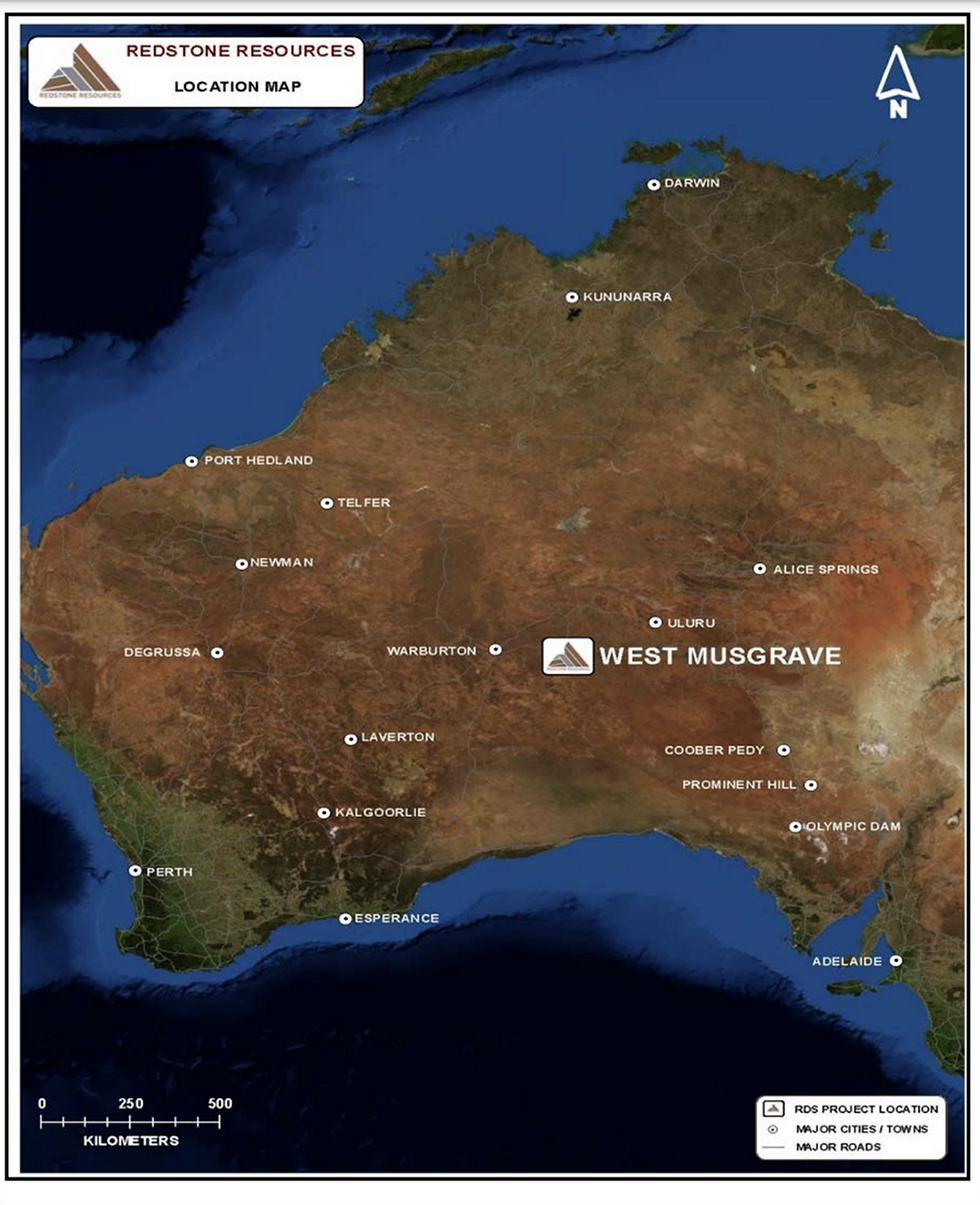

Redstone Resources (ASX: RDS) is a base and rare-earth elements expedition business, exploring its 100-percent-owned, extremely potential West Musgrave Job, that includes the Tollu Copper deposit, situated in the West Musgrave Province of Western Australia. The business’s West Musgrave Job lies proximal to BHP’s first-rate Nebo-Babel nickel-copper-PGE sulphide deposit and Succoth copper (nickel, palladium) deposit, and Nico Resources’ Wingellina nickel-cobalt task. Redstone likewise has other pending tenement applications potential for nickel and copper in the very same area. The business is led by a management group with knowledge in geology and mineral expedition, service advancement and business law, developing self-confidence in the group’s capability to profit from its possessions.

The special Musgrave surface has actually currently drawn the interest of significant miners, such as OZ Minerals, now owned by BHP. BHP is advancing with the advancement of its Nebo-Babel nickel-copper-PGE sulphide deposit, which has actually been approximated to have a resource of 390 million tonnes grading 0.33 percent copper and 0.30 percent nickel, for 1.2 million tonnes of included nickel metal and 1.3 million tonnes of included copper metal (Mea + Ind + Inf– 2012 JORC). Last regulative approval to start building and construction of the Nebo-Babel mine has actually been approved. Other discoveries and deposits in the location, such as the Wingellina nickel-cobalt deposit, show the capacity of the West Musgrave area to end up being a considerable base metal jurisdiction.

Redstone’s flagship, 100-percent-owned West Musgrave Job is located in between these 2 deposits– roughly 40 kilometers east of BHP’s Nebo Babel nickel-copper-PGE deposit and 50 kilometers west-southwest of Nico Resources’ Wingellina nickel-cobalt deposit. Redstone’s West Musgrave Job is extremely potential yet mostly underexplored. The possession has the ideal geological and structural setting for big magmatic nickel-copper sulphide deposits, volcanic-hosted enormous sulphide (VHMS) deposits and other big invasive associated hydrothermal systems.

Place of Redstone’s West Musgrave Job, that includes the Tollu copper deposit, in relation to the first-rate Nebo-Babel Ni-Cu-PGE deposit.

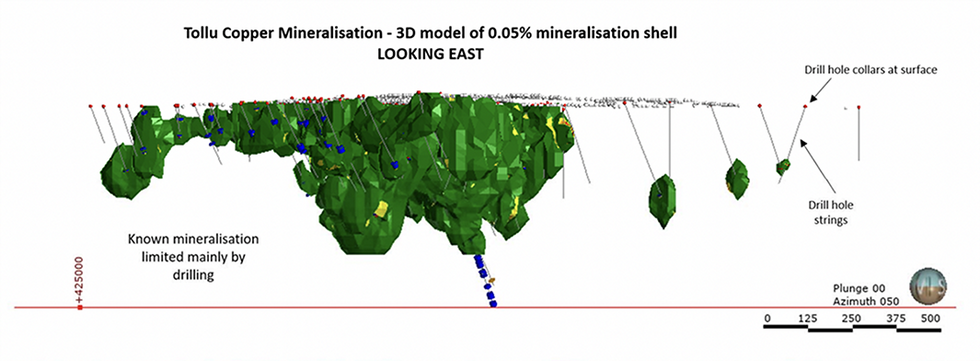

The 100-percent-owned Tollu Copper Vein deposit, situated within the West Musgrave Job, has a JORC-compliant indicated and presumed resource price quote of 3.8 million tonnes grading 1 percent copper, for 38,000 tonnes of included copper with a cut-off of 0.2 percent. There is likewise a present approximated conceptual expedition target *, which recommends a capacity for approximately 627,000 tonnes of copper at Tollu. (* conceptual expedition target varies from 31 to 47 million tonnes of mineralization at 0.8 to 1.3 percent copper, including 259,000 to 627,000 tonnes copper.)

Redstone Resources likewise participated in a joint endeavor contract with Galan Lithium (ASX: GLN) to obtain one hundred percent of the extremely potential suite of lithium jobs that consist of Camaro, Taiga and Hellcat in the James Bay Lithium Province in Quebec. Redstone will be the supervisor of the joint endeavor which covers 5,187 hectares of period. The joint endeavor likewise protected a choice to obtain one hundred percent of the PAK East and PAK Southeast Lithium Projects made up of 1,415 hectares in Ontario’s Electric Opportunity near Frontier Lithium’s (Frontier) PAK Lithium Job.

A skilled management group leads Redstone with years of experience in the mineral resources sector, with knowledge in mineral expedition, mining operations and business financing.

Business Emphasizes.

- Redstone Resources is an Australia-based mineral expedition business checking out extremely potential homes for copper and nickel in the West Musgrave area of Western Australia.

- The West Musgrave area has actually currently drawn the interest of miners who have actually made considerable discoveries, consisting of the first-rate Nebo-Babel nickel-copper-PGE sulphide deposit and the Wingellina nickel-cobalt deposit.

- Redstone’s jobs remain in close distance to these existing jobs, showing the capacity of the business’s period.

- The business owns one hundred percent of the West Musgrave Job, that includes the Tollu Copper vein deposit.

- It has the ideal geological and structural setting for big magmatic nickel-copper sulphide deposits, VHMS deposits and other big intrusive-related hydrothermal systems

- The Tollu Copper vein deposit is evidence of a considerable hydrothermal system in the task location.

- The business has actually likewise just recently participated in an contract to obtain a 100-percent interest in the Attwood Lake Location Lithium homes, situated in northwestern Ontario, Canada, understood to be extremely potential for lithium and uncommon component pegmatites, and in close distance to a number of sophisticated lithium jobs.

- The Attwood Job acquisition matches the business’s West Musgrave copper-nickel task and its method to increase direct exposure to the growing worldwide battery metals and check out for crucial minerals in high need.

- Redstone Resources participated in a joint endeavor contract with Galan Lithium (ASX: GLN) to obtain one hundred percent of extremely potential suite of lithium jobs in Quebec and Ontario.

- A strong management group leads the business with years of experience in the resources sector.

Secret Jobs.

The West Musgrave Job

The West Musgrave Job covers 237 square kilometers of extremely potential yet underexplored surface. The possession is 40 kilometers east of the first-rate Nebo- Babel nickel-copper-PGE sulphide deposit owned by BHP’s OZ Minerals, and consists of ideal geological structure and settings for nickel-copper deposits. Redstone prepares to continue the expedition of the possession to act on current drilling and expedition outcomes which determined many potential targets.

Job Emphasizes:

- Promising Geological Setting: The task hosts the ideal geological and structural setting for big magmatic nickel-copper sulphide deposits, VHMS deposits, and other big invasive associated hydrothermal mineralizing systems.

- Exceptional Expedition Outcomes to Date:

- The 2022 RC drill project carried out at the West Musgrave task returned with the greatest copper grade ever to be experienced at the task, with a 1 meter crossway at 18.5 percent copper from just 18 meters downhole at the Forio Possibility.

- The current RC drilling likewise validated the existence of mafic-ultramafic nickel source target rocks at West Musgrave– drill holes TLC183 and TLC196 have actually converged a Hi-Mg mafic-ultramafic invasion with raised nickel and chromium at the West Stogie Magnetic Target, some 7.5 kilometers northeast of the Tollu Copper Deposit.

- This is the very first time prospective host or source rocks for nickel, copper, cobalt and platinum group components (PGE) have actually been converged on the task, which is considerable thinking about the western border of the task location is just 40 kilometers east of BHP’s (ASX: BHP) Nebo-Babel nickel-copper-cobalt-PGE deposit.

- Extra Expedition Just Recently Finished: More outcomes stay pending for the 2022 second-phase RC drilling program.

- Considerable Expedition Benefit: Drilling to date has actually concentrated on less than 10 percent of the task– mostly around the exposed copper veins at Tollu.

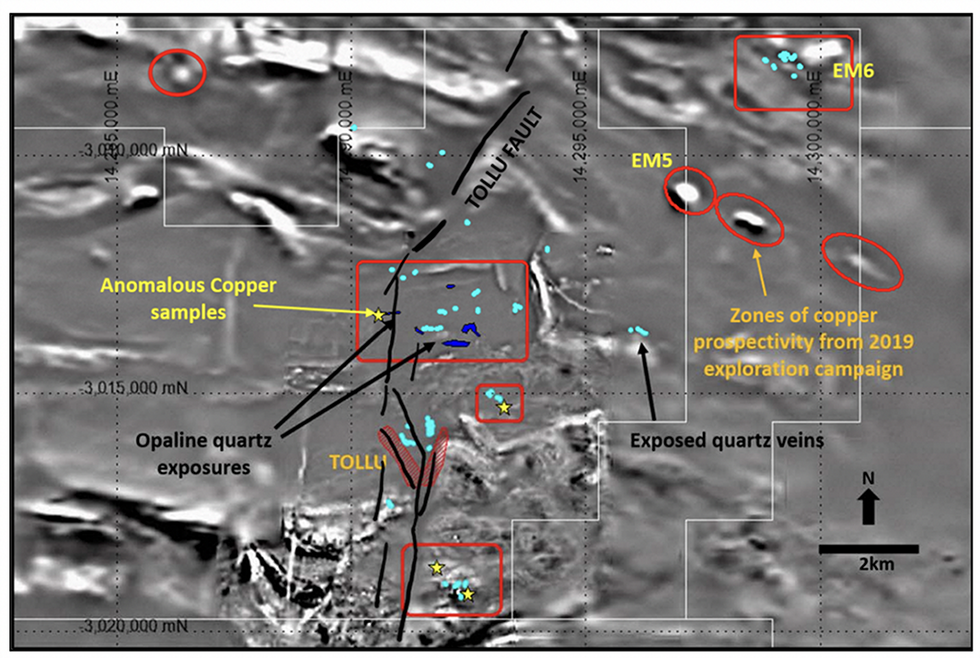

Place of the anomalous copper samples (yellow stars) and the brand-new target locations of prospectivity (red limits) determined by the current expedition project (geological mapping and drilling). Opaline quartz is mapped in dark blue and quartz vein outcrops are mapped in light blue.

The Tollu Copper Vein Job

Redstone’s Tollu Copper Vein deposit lies within the wider West Musgrave Job and has actually currently produced appealing drilling outcomes. Tollu hosts a huge swarm of hydrothermal copper-rich veins in a mineralized system covering a location of a minimum of 5 square kilometers. Copper mineralization is exposed at the surface area and types part of a dilation system within and in between 2 significant shears.

Redstone has actually specified a JORC 2012 resource price quote for Tollu of 3.8 million tonnes grading 1 percent copper, for 38,000 tonnes of included copper and 0.01 percent cobalt, which corresponds to 535 tonnes of included cobalt, nevertheless, the business thinks about that this price quote might be far higher with more drilling.

Job Emphasizes:

- Tollu Resource Price Quote: The Tollu Copper Vein deposit has a JORC-compliant resource price quote of 3.8 million tonnes grading at 1 percent copper for 38,000 tonnes of included copper.

- Conceptual Expedition Target * Might Broaden Resource Price Quote: A conceptual expedition target has actually been approximated on the Tollu Copper Vein system which recommends a capacity of 627,000 tonnes of extra copper.

- Opportunities for Resource Growth: The 38,000-tonne copper resource might be far higher with more drilling, and continued drilling at Tollu highlights chances for extensions of the thick top-quality copper mineralization converged in historic drill holes, consisting of towards shallower depth, and subsequently prospective chances to broaden the Tollu resource. Drilling arises from 2017 to present are not yet consisted of in the existing Tollu resource. Furthermore, the source of the Tollu copper has actually not yet been effectively evaluated at depth.

- Considerable Historic High-Grade Copper Outcomes— near surface area and at depth: Considerable top-quality copper has actually been converged at Tollu from near surface area to approximately 434 meters deep consisting of with grades as high as 3.25 percent copper over 14 meters (from 25 meters depth) (TLC153) at the Forio possibility, and 10 meters at 3.4 percent copper from 424 meters deep and still open, consisting of 5 meters at 5.3 percent copper from 427 meters deep (TLC80) at the Chatsworth possibility.

- Current Drilling Continues State-of-the-art Outcomes:

- Current drilling at Chatsworth has actually extended the vertical connection of the copper mineralization in a few of the historic drill holes to double that previous with a minimum of some 100 meters of the vertical level and open at depth and towards the surface area.

- The considerable, late 2021 top-quality copper crossways drilled at Chatsworth consist of:

- 10 meters at 2.51 percent copper from 174 meters downhole (TLC188) consisting of:

- 3 meters at 4.71 percent copper from 175 meters downhole;

- 26 meters at 1.46 percent copper from 61 meters downhole (TLC189) consisting of:

- 1 meter at 5.1 percent copper from 84 meters downhole;

- 16 meters at 2.88 percent copper from 74 meters downhole (TLC190) consisting of:

- 9 meters at 4.6 percent copper from 76 meters downhole, that includes

- 2 meters at 7.62 percent copper from 76 meters downhole;

- 22 meters at 1.26 percent copper from 104 meters downhole (TLC190) consisting of:

- 3 meters at 3.67 percent copper from 122 meters downhole; and

- 25 meters at 1.10 percent copper from 53 meters downhole (TLC192) consisting of:

- 7 meters at 2.64 percent copper from 60 meters downhole.

- Late 2021 drilling at Forio continued the top-quality drilling results at this possibility with a single 34-meter crossway grading 1.07 percent copper from just 15 meters depth downhole (TLC181) consisting of:

- 2 meters at 3.21 percent copper from 19 meters downhole;

- 1 meter at 2.48 percent copper from 28 meters downhole;

- 1 meter at 1.99 percent copper from 35 meters downhole; and

- 1 meter at 2.52 percent from 40 meters downhole

- Geochemical assays from the late 2022 RC drilling project have actually validated the greatest copper grade ever converged at Tollu with 1 meter @ 18.5 percent copper from 18 meters downhole (TLC203). The more considerable high- grade copper mineralization crossways at Forio consist of:

- 8 meters at 4.1 percent copper from 13 meters downhole depth in drill hole TLC203, consisting of 1 meter at 18.5 percent copper from 18 meters downhole;

- 4 meters at 1.2 percent copper from 45 meters downhole in drill hole TLC203; and

- 6 meters at 1.47 percent copper from 80 meters downhole in drill hole TLC201.

- The top-quality copper crossways in drill holes TLC201 and TLC203 extend Forio’s top-quality copper mineralization zone to a 60-meter strike length (north and south) of constant top-quality copper.

- The current Forio drilling has actually revealed that thick top-quality copper lenses have the prospective to cross considerable ranges along strike and to depth.

- Easy Oxide Copper Chance: The considerable crossways of Tollu mineralization approximately the surface area supports examination of an easy oxide copper resource chance– the Tollu drilling from 2017 to date recommends a capacity for a boost from 8,000 tonnes of oxide copper currently specified in the Tollu resource.

Board and Management.

Richard Homsany – Non-executive Chairman

Richard Homsany is executive vice-president of Mega Uranium Ltd, a Toronto Stock market noted business and executive chairman of Toro Energy Limited, an ASX noted uranium business. He is likewise presently the non-executive chairman of Galan Lithium Ltd and the Medical Insurance Fund of Australia Limited.

Prior to this Homsany was a business and industrial advisory partner with among Australia’s leading law practice. He is presently the principal of Cardinals Attorneys and Professionals and has actually been confessed as a lawyer for over twenty years. Homsany has comprehensive experience in business law, consisting of encouraging public resources and energy business on business governance, financing, capital raisings, takeovers, mergers, acquisitions, joint endeavors and divestments.

He likewise has considerable board experience with openly noted resource business and in the resources market. He has actually likewise worked for an ASX leading 50-listed globally varied resources business in operations, threat management and business.

Homsany is a qualified practicing accounting professional and is a fellow of the Financial Providers Institute of Australasia (FINSIA). He has a commerce degree and honors degree in law from the University of Western Australia and a graduate diploma in financing and financial investment from FINSIA.

Brett Hodgins – Technical Director

Brett Hodgins has more than twenty years of expert experience in the resources sector mostly concentrated on expedition and mining operations. He started his profession as a geologist with Bathrobe River Mining and Rio Tinto Iron Ore. Throughout that time he was included with the commissioning and advancement of the West Angelas and Hope Downs operations. Hodgins’ current functions consist of basic supervisor task advancement for Iron Ore Holdings and he is president/CEO of Central Iron Ore Ltd, a TSXV noted business gold and iron ore explorer. He brings a wide variety of experience in expedition, expediency research studies, operations, and has a broad understanding of the resource sector.

Hodgins has actually finished a bachelor’s degree degree with honors in geology from Newcastle University, diploma of management and a graduate diploma in financing and financial investment from FINSIA.

Edward van Heemst – Non-executive Director

Edward van Heemst is a popular Perth entrepreneur with over 40 years of experience in the management of a varied variety of activities with big personal business.

He is the handling director of Lead Press and was formerly the veteran chairman of Perth Racing (1997 to 2016). He was likewise designated as non-executive chairman of NTM Gold Ltd, an ASX-listed business from July 2019 to March 2021.

Van Heemst holds a bachelor of commerce degree from the University of Melbourne, an MBA from the University of Western Australia and belongs to the Institute of Chartered Accountants Australia.

He has comprehensive understanding of capital markets and developed mining market networks.

Dr. Greg Shirtliff– Geological Expert

Dr. Greg Shirtliff has more than twenty years’ experience in industry-related geology and geochemistry, consisting of a PhD in mine-related geology from the Australian National University. Because his research studies, Shirtliff has actually invested over 17 years in numerous functions in the mining and expedition market varying from ecological, mine geology, resource advancement, expedition and management functions, expedition and technical jobs inclusive of engineering and metallurgical. His functions have actually consisted of a variety of years at ERA-Rio Tinto’s Ranger Uranium Mine, as the senior geoscientist for Cameco Australasia and more just recently as the lead geologist and technical supervisor for Toro Energy Ltd, an ASX-listed uranium advancement business in Australia where he is the expedition and technical lead accountable for increasing the practicality of the business’s uranium and mineral resources, establishing and directing the business’s uranium and non-uranium expedition method, helping the business technically through EPA approval for a uranium, and assisting the engineering and metallurgical through to scoping level financial evaluation.

Shirtliff has actually had current expedition success at Toro Energy, finding several zones of enormous nickel sulphide mineralization along the Dusty Komatiite, probably the very first enormous nickel sulphide mineralization found in the Yandal Greenstone Belt in Western Australia.

Shirtliff holds directorships on independently owned consultancy and prospecting business.

Shirtliff is an enduring member of the Australian Institute of Mining and Metallurgy and the globally acknowledged Society of Economic Geologists.