In simply over a years, Bitcoin has actually grown a cult-like following and rose to remarkable heights. Now the cryptocurrency of option, its meteoric increase has actually differed from any other product, resource or property– and it has actually seen gains once again in 2023.

Bitcoin, the most widely known cryptocurrency, has actually led the way for the growing cryptocurrency property class, rising to an all-time high of US$ 68,649.05 on November 10, 2021. Gaining from excess money in the marketplace and financier interest, the rate of Bitcoin increased more than 1,200 percent in between March 2020 and November 2021 before stammering in 2022.

When it comes to its rate history this year, Bitcoin began 2023 around the US$ 16,000 mark, however has actually considering that increased towards completion of Q4 to trade at US$ 37,885 since November 15, 2023.

What has stimulated Bitcoin’s rate motions in the last few years, and why is it back up now? Continue reading to discover.

What is Bitcoin?

Produced to counter the 2008 monetary crisis, Bitcoin has actually weathered severe volatility, increasing to US$ 19,650 in 2017 before investing years locked listed below US$ 10,000. The cryptocurrency was revealed in late 2008 with the objective of transforming the financial system, and was initially presented in a white paper entitled ” Bitcoin: A Peer-to-Peer Electronic Money System.”

The 9 page manifesto was penned by an infamously evasive individual (or individuals) who utilized the pseudonym Satoshi Nakamoto, and it sets out an engaging argument and foundation for the production of a cyber-currency.

Cryptographically protected, the peer-to-peer electronic payment system was created to be transparent and resistant to censorship, utilizing the power of blockchain innovation to produce an immutable journal avoiding double costs. The real attraction for Bitcoin’s early adopters remained in its prospective to battle power far from banks and monetary institutes and provide it to the masses.

This was particularly luring as the fallout from the 2008 monetary collapse ricocheted worldwide. Referred to as the worst monetary crisis considering that the Great Anxiety, US$ 7.4 billion in worth was eliminated from the United States stock exchange in 11 months, while the international economy diminished by an approximated US$ 2 trillion.

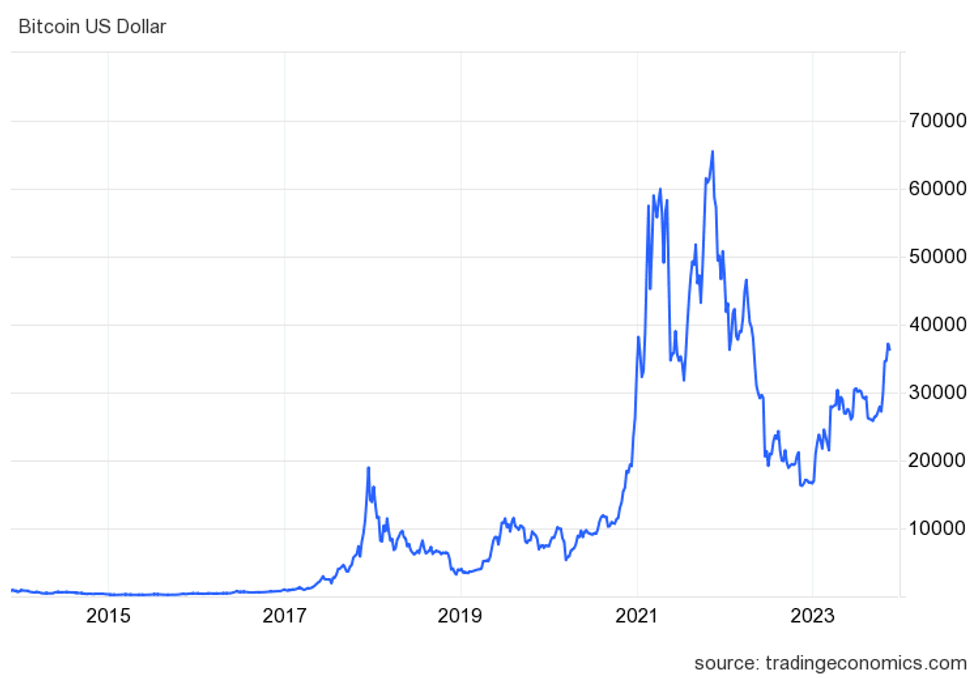

Bitcoin rate in United States dollars, beginning to November 16, 2023

Chart through TradingEconomics.com

In July 2010, Bitcoin started trading at US$ 0.0008, reaching US$ 0.08 by month’s end. The cryptocurrency then carried out reasonably flatly, gradually increasing into the US$ 10 variety up until it increased to US$ 250 in April 2013.

The number of Bitcoins exist?

Unlike standard currencies that can increase flow through printing, the variety of Bitcoins is limited. There are 21 million out there, of which 19,144,112 remain in flow, leaving simply under 2 million to be mined.

This limitation is a core function of Bitcoin’s algorithm, and was created to balance out inflation by preserving shortage.

A brand-new Bitcoin is developed when a Bitcoin miner utilizes extremely specialized software application to finish a block of deal confirmations on the Bitcoin blockchain. Approximately 900 Bitcoins are presently mined daily; nevertheless, after 210,000 blocks are finished, the Bitcoin procedure immediately lowers the variety of brand-new coins provided by half.

Halvings have actually taken place every 4 years considering that 2012, with the most current taking place in May 2020. Cutting in half not just combats inflation, however likewise supports the cryptocurrency’s worth by guaranteeing that its rate will increase if need stays the exact same.

At the minute, miners are paid 6.25 Bitcoin for every single block they finish.

How did COVID-19 impact the Bitcoin rate?

January 1, 2016, marked the start of Bitcoin’s continual rate increase. It began the year at US$ 433 and ended it at US$ 959– a 121 percent worth boost in 12 months.

The next year brought the mainstream adoption of Bitcoin. In Between January and December 2017, extra attention, the intro of brand-new cryptocurrencies and protection from traditional monetary media included 1,729 percent to the crypto-coin’s worth– it increased from US$ 1,035.24 in January to US$ 18,940.57 in December.

This record-setting limit was unsustainable, and Bitcoin came down with its own volatility, which gradually deteriorated its previous gains. In spite of that reduction in worth, the virtual currency still held above US$ 3,190, a low it has not strike once again because that time.

Given that introducing in 2008, challengers of Bitcoin have actually utilized its brief history to safeguard their resistance. Concerns have actually emerged around how Bitcoin would carry out throughout a monetary crisis or economic crisis, as the coin is exceptionally prone to unpredictability.

2020 showed a testing room for the digital coin’s capability to weather monetary turmoil. Beginning the year at US$ 6,950.56, a prevalent selloff in March brought its worth to US$ 4,841.67– a 30 percent decrease.

The low developed a purchasing chance that assisted Bitcoin get back its losses by Might. Like safe-haven metal gold, Bitcoin started to become a protective property for the Millennial and Generation Z crowd. The rally continued throughout 2020, and the digital property ended the year at US$ 29,402.64, a 323 percent year-over-year boost and a 507 percent increase from its March drop.

By contrast, gold, among the best-performing products of 2020, included 38 percent to its worth from the low in March through December, setting what was then an all-time high of US$ 2,060 per ounce in August.

What was the greatest rate for Bitcoin?

Bitcoin’s climb continued in 2021, rallying to an all-time high of US$ 68,649.05 in November, a 98.82 percent boost from January. The digital property shed a few of its worth to end the year at US$ 47,897.16– still a 62 percent year-over-year boost.

So what caused this all-time high? A couple of various aspects functioned as rate drivers.

Much of the development in 2021 was credited to risk-on financier cravings, along with Tesla’s (NASDAQ: TSLA) purchase of US$ 1.5 billion worth of Bitcoin. Activity was more intensified when Tesla reported strategies to start accepting Bitcoin as payment for its electrical lorries. Nevertheless, following some criticism from financiers and ecologists, the electrical vehicle maker revealed in 2021 that it would be carrying out due diligence on the quantity of renewable resource utilized to mine the cryptocurrency before enabling clients to purchase vehicles with it; nevertheless, the choice might be back on the table as Musk stated in September of this year that the level of renewable resource usage in the crypto market had actually reached a proper limit.

Increased cash printing in action to the pandemic likewise benefited Bitcoin, as financiers with more capital aimed to diversify their portfolios. The success of the world’s very first cryptocurrency amidst the marketplace ups and downs of 2020 and 2021 caused more interest and financial investment in other coins and digital properties also. For instance, 2021 saw the increase of the non-fungible token (NFT). Making use of blockchain innovation, NFTs are distinct crypto properties that are kept, offered and traded digitally.

The NFT principle is mainly utilized for art and other digital mediums to enable purchasers to own a particular property. It is approximated that the NFT market grew to more than US$ 40 billion in 2021, driven specifically by cryptocurrencies, the only type of payment for NFTs. Nevertheless, since mid-November 2023, the NFT market price has actually fallen considerably down to US$ 7.39 billion.

Bitcoin’s mainstream use might be an ongoing rate driver as more companies accept the digital token as payment; the growing market for digital properties might likewise include momentum for the cryptocurrency area.

What is Bitcoin at today?

While prestige has actually catapulted the very first digital currency to all-time highs, the main headwind for the crypto coin is its regular volatility, which was on complete screen in 2022. Market unpredictability taxed the world’s very first specifically digital currency. Throughout the 2nd quarter of 2022, worths dived listed below US$ 20,000 for the very first time considering that December 2020. By the end of that year, rates for Bitcoin had actually moved even lower to settle listed below US$ 17,500 BTC.

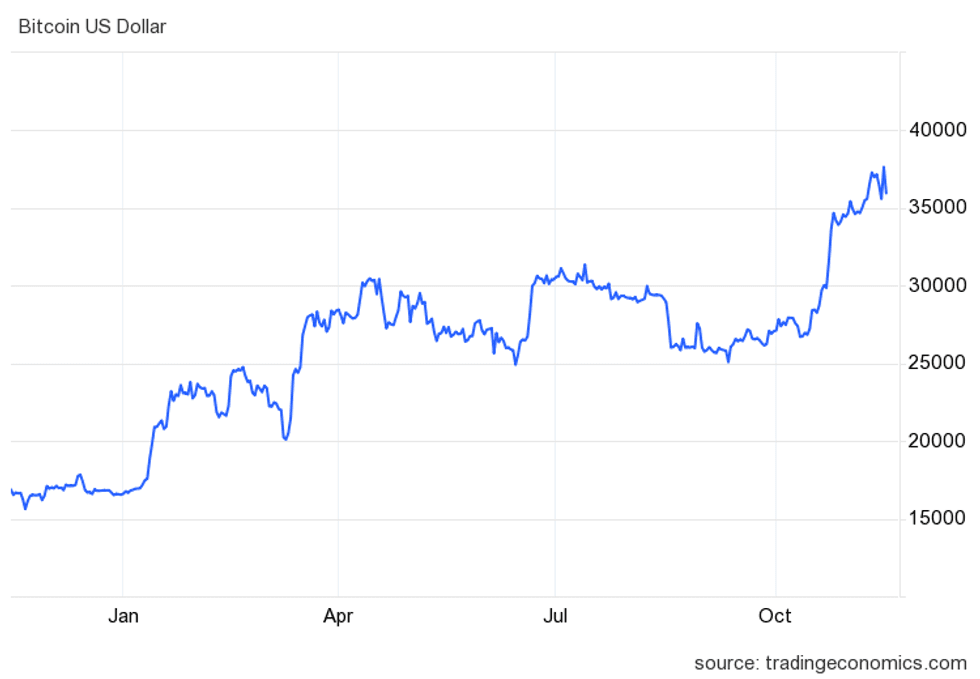

2023 began on a brilliant note for the rate of Bitcoin, as it rallied in mid-January, returning to almost US$ 24,000. It then dropped in the 2nd week of March to around US$ 20,200, however the following days saw it increase once again— Bitcoin leapt greatly to US$ 28,211 by March 21 after the failure of numerous United States banks alarmed financiers.

Bitcoin rate in United States dollars, November 15, 2022 to November 15, 2023

Chart through TradingEconomics.com

In Q2, Bitcoin continued its climb, supporting above US$ 25,000 even as the SEC submitted suits versus Coinbase International (NASDAQ: COIN), together with Binance and its creator Changpeng Zhao.

” They tried to avert United States securities laws by revealing sham controls that they ignored behind the scenes so that they might keep high-value U.S. clients on their platforms,” SEC Chair Gary Gensler stated in a news release. “The general public needs to be careful of investing any of their hard-earned properties with or on these illegal platforms.”

Although it appeared like problem for the sector, Bitcoin remained stable, holding above US$ 25,000. This was supported by BlackRock (NYSE: BLK) declare a Bitcoin exchange-traded fund with the SEC on June 15. Although the SEC hasn’t authorized applications for area Bitcoin ETFs formerly, the assistance from BlackRock, which is the world’s biggest property supervisor, has actually shown bullish.

Bitcoin’s rate leapt above US$ 30,000 on June 21, and on July 3, the crypto struck its greatest rate considering that Might 2022 at US$ 31,500. It held above US$ 30,000 for almost a month previously dropping simply listed below on July 16. By September 11, rates had actually moved even more to US$ 25,150.

Heading into the last months of the year, the Bitcoin rate is taking advantage of increased institutional financial investment as the possibility of the United States Securities Exchange Commission (SEC) authorizing a bunch of area Bitcoin exchange-traded funds by early 2024. Since November 15, 2023, the rate for the popular cryptocurrency was trading at US$ 37,885.

In spite of its drop from the enormous rate highs seen in the past, Bitcoin’s effective efficiency, current continual development and future capacity can not be downplayed.

Frequently asked questions for buying Bitcoin

What is a blockchain?

A blockchain is a digitized and decentralized public journal of all cryptocurrency deals.

Blockchains are continuously growing as finished blocks are tape-recorded and included sequential order. The system by which digital currencies are mined, blockchain has actually ended up being a popular financial investment area as the innovation is significantly being executed in service procedures throughout a range of markets. These consist of banking, cybersecurity, networking, supply chain management, the Web of Things, online music, health care and insurance coverage.

How to purchase Bitcoin?

Bitcoin can be bought through a range of crypto exchange platforms and peer-to-peer crypto trading apps, and after that kept in a digital wallet. These consist of Coinbase International, CoinSmart Financial (OTC Pink: CONMF, NEO: SMRT), BlockFi, Binance and Gemini.

What is Coinbase?

Coinbase Global is a safe online cryptocurrency exchange that makes it simple for financiers to purchase, offer, move and save cryptocurrencies such as Bitcoin.

How does crypto impact the banking market?

Cryptocurrencies are an option to standard banking, and tend to draw in individuals thinking about properties that are outdoors mainstream systems. According to information from Statista, 53 percent of crypto owners are in between the ages of 18 and 34, revealing that the market is drawing more youthful generations who might have an interest in decentralized digital alternatives.

Personal privacy is an essential draw for cryptocurrency owners, as is the reality that they are separated from 3rd parties such as reserve banks. Furthermore, crypto deals, consisting of purchases, sales and transfers, are typically fast and have less involved costs than deals going through the banking system in the common way.

That stated, banks are beginning to see how popular cryptocurrencies are. As Bitcoin and its compatriots end up being significantly traditional, lots of banks have actually started to invest in cryptocurrencies and blockchain business themselves.

Will Bitcoin gain from the banking crisis?

The banking crisis in the United States and in other places has actually currently caused a speedy rush to Bitcoin from worried financiers. What began with the failure of Silicon Valley Count On March 10, 2023, was followed by the collapse of Signature Bank 2 days later on, causing worry as financiers and banking market customers fretted about what would follow. UBS’ (NYSE: UBS) acquisition of its stopping working Switzerland-based competing Credit Suisse stired issues even more.

While the banking crisis has actually relatively declined into the background of financial news headings, lots of experts state it hasn’t disappeared and we can anticipate to see more fallout in the local banking sector.

Bitcoin was developed in the wake of the 2008 monetary crisis as an option to the standard banking market, and in the previous the rate of Bitcoin has actually typically moved on story and belief. Nevertheless, increasing policies and its historical volatility make it tough to anticipate where the cryptocurrency might move next, particularly as the crisis continues to unfold.

Just how much was Bitcoin when it began?

The very first tape-recorded Bitcoin deal not including the creator was available in late 2009, when 5,050 Bitcoins were traded for US$ 5.02 over PayPal (NASDAQ: PYPL), pegging the worth for 1 Bitcoin at about US$ 0.001– a 10th of a cent.

Will Bitcoin increase once again?

Bitcoin has actually invested 2023 climbing up up, revealing a pattern of screening and after that holding above brand-new rate levels. While it’s difficult to understand how high it will increase in 2024, or if it might reach the highs it saw in 2021, the cryptocurrency has actually shown that its time isn’t over.

Is Bitcoin an excellent financial investment any longer?

While Bitcoin has actually been climbing up in worth in 2023, particularly in these last couple of months, among its widely known functions is its volatility. Financiers who are more accepting of threat might aim to the cryptocurrency area as there traditionally has actually been cash to be made, and Bitcoin is gaining back worth after dropping in 2022. Nevertheless, there is likewise traditionally cash to be lost, and financiers who choose to take smaller sized threats need to look towards other opportunities.

For more details on buying Bitcoin today, take a look at our post Is Now a Great Time to Purchase Bitcoin?

What is Cathie Wood’s forecast for Bitcoin?

Cathie Wood of ARK Invest is a strong advocate of Bitcoin, and has enthusiastic forecasts for the coin’s future. In a current interview with CNBC following the SEC suits versus Binance and Coinbase, Wood stated she has a base-case target of US$ 600,000 for Bitcoin by 2030, and a bull-case target of over US$ 1 million.

Who has the most purchased Bitcoin?

Satoshi Nakomoto, the strange creator of Bitcoin, is thought to likewise be the most significant holder of the coin. Analysis into early Bitcoin wallets has actually exposed that Nakamoto most likely owns over 1 countless the almost 19.5 million Bitcoins out there.

Does Elon Musk own Bitcoin?

Tesla and Twitter CEO Elon Musk’s association with both Bitcoin and the meme coin Dogecoin is popular, and both his tweets and Tesla’s actions have actually affected the cryptocurrencies’ trajectories for many years.

While it is unidentified simply just how much he owns, Musk has actually divulged that he personally has holdings of Bitcoin and Dogecoin, along with Ether. When it comes to Tesla, as talked about above, the business bought US$ 1.5 billion of Bitcoin in 2021, however offered 75 percent of that the next year. Since October 2023, the EV maker’s Bitcoin holdings were approximated at 9,720 Bitcoin, “the third-largest bitcoin holdings for an openly traded business,” reports Coin Desk

It was exposed in September that Musk might be financing Dogecoin secret, according to Forbes.

Does Warren Buffett own Bitcoin?

Warren Buffett does not own Bitcoin, and has actually revealed his dislike of cryptocurrencies in the past.

The most current circumstances was available in an April interview with CNBC, when he stated this of Bitcoin: “It’s a betting token. It does not have any worth, however that does not stop individuals from wishing to play a live roulette wheel.”

Buffett shared his disinterest the previous year also at a yearly investors fulfilling for Berkshire Hathaway (NYSE: BRK.A, NYSE: BRK.B).

” If you informed me you own all of the bitcoin worldwide and you provided it to me for $25, I would not take it due to the fact that what would I finish with it?” he stated. “I ‘d need to offer it back to you one method or another. It isn’t going to do anything.”

This is an upgraded variation of a short article initially released by the Investing News Network in 2021.

Do not forget to follow us @INN_Technology for real-time updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct financial investment interest in any business discussed in this post.

From Your Website Articles

Associated Articles Around the Web